Unpacking Outsourcing and Offshoring: Exploring Their Impact on Australia’s Talent Landscape

Darragh Cleary, who leads Kaizen Recruitment’s Investment Operations and Accounting division in Sydney, recently met with Greig Nicholson to discuss the landscape and evolution of outsourcing across funds management in Australia and its impact on Australia’s talent landscape. Greig is a Partner with Mavin Advisory Group, a specialist investment and wealth management consulting firm he helped establish in 2019. He has held various operations and change leadership roles in Australia and the UK over the last 25 years.

Introduction and Background

Outsourcing has become commonplace for fund managers and super funds in Australia. “Outsourcing enables investment managers and super funds to focus on their core capabilities whilst specialist providers take care of the non-core activities,” explains Greig Nicholson. This shift has been driven by the growing demands and complexity of administering their funds from an increase in funds under management (FUM), growth in products & multi-tiered structures, requiring access to global markets, support for new asset classes and an ever-changing regulatory environment.

Initially, traditional custody activities were the primary outsourced function, but over time, fund administration and investment operations functions followed. Nicholson notes that “various specialist providers have expanded their offerings to include a range of value-add activities, such as securities lending, outsourced trading and technology & data solutions, thereby becoming ‘one-stop shops’ for funds.”

In turn, third-party service providers continuously develop their operating models to effectively and efficiently service their clients, resulting in changes to organisational structures, processing footprints and technology.

Together, we explored the evolution of the service provider landscape and the growth of outsourcing in Australia, the forms of outsourcing, considerations to take when outsourcing, the impact on talent and the outlook for the coming years.

The Evolution of Outsource Service Providers in the Australian Market

The landscape of outsourcing service providers in Australia has evolved significantly over the years. “Acquisitions have been integral to the changing landscape in the Australian market over the last 20+ years,” noted Nicholson.

NAB’s journey in the domestic custody space dates back to the 1950s, with investment administration services since 1975. Several failed attempts to sell NAB Asset Servicing (NAS), with JP Morgan, State Street and HSBC all possible suitors in 2006, 2014 and 2022 respectively have preceded a flurry of RFP activity to select new service providers following NAS’ decision in 2022 to exit the market. Transitions from NAS to the new service providers will continue into 2025.

Nicholson highlights “State Street was the first global bank offering master custody services to the Australian market, opening an office in Sydney in 1986 and through the early 2000s to 2010, several domestic organisations sold their administration businesses, giving rise to global banks operating in the marketplace”. BNP Paribas acquired AMP’s Cogent business, JP Morgan acquired from ANZ, HSBC from Westpac, and RBC acquired Perpetual’s custody and investment administration business.

RBC’s decision in 2019 to exit the Australian securities services market was an enabler for Citi to position themselves more dominantly in the market through a memorandum of understanding arrangement to take on many of RBC’s clients throughout 2020 and 2021.

Several other organisations have made a mark in the Australian market of late, providing alternative offerings to the global banks, including MUFG who acquired Link Market Services, Artega (a strategic partnership between Challenger and Simcorp), Apex acquiring Mainstream, One Investment Group, Citco, and Alter Domus, to name a few.

Registry has also seen activity with SS&C acquiring IRESS’ Managed Funds Administration business and the likes of Automic and Grow winning market share through strong investment in technology offerings and administration capabilities.

In recent times, numerous fund manager acquisitions and superannuation fund mergers have led to the consolidation of their service providers. Furthermore, corporate governance requiring periodic review of service providers can sometimes result in the decision to change service providers.

Development of Service Provider Operating Models

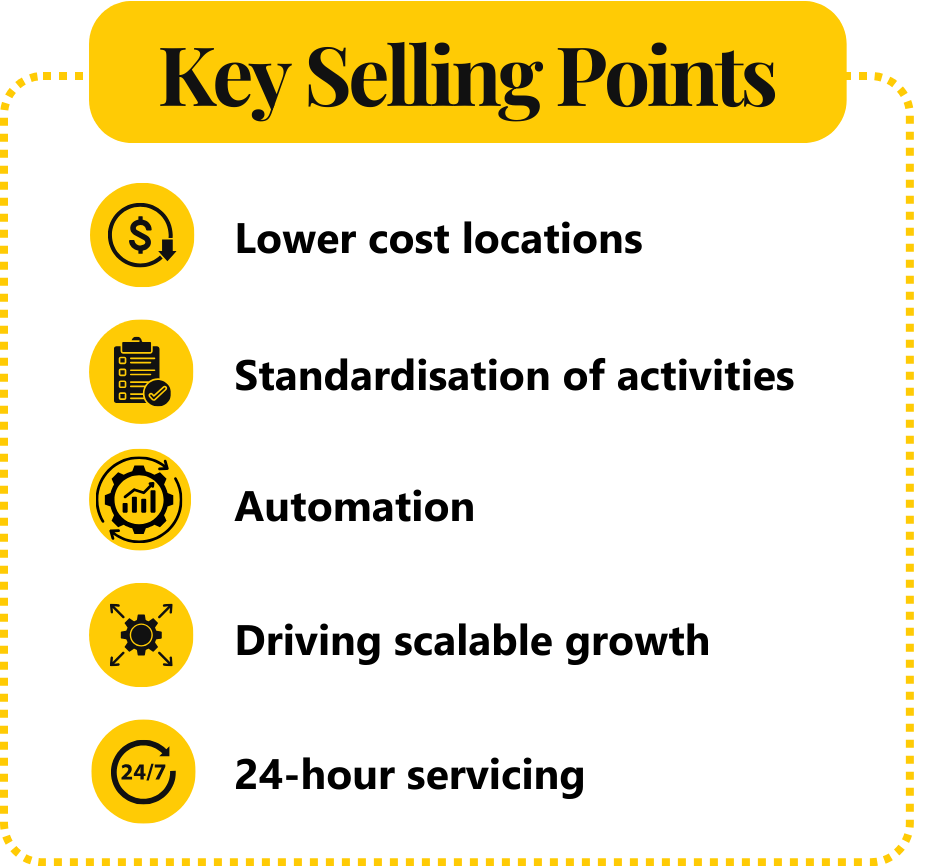

Service provider operating models have evolved to handle the significant increase in assets (ACSA data at 30-Jun-24 shows Assets Under Custody (AUC) has surpassed $5 trillion for the first time) they are servicing and managing the associated risks. According to Nicholson, this evolution has led to global service providers establishing functional processing hubs, commonly referred to as centres of excellence, along with a heavy investment in technology. Nicholson explains that the evolution has supported the commercial pressures on custody and asset servicing fees by operating in lower-cost locations, standardising activities, automation, driving scale, and offering 24-hour servicing.

The offshore hub’s supporting Australian Clients are predominantly located in China, India, the Philippines and Malaysia, with additional sites in Europe and the US as global service providers adopt 24-hour follow-the-sun (pass the book) servicing models. The last 15 years or so, have seen a significant volume of processing activities transition from roles and offices across Australia to the offshore hubs, with much of the work for some functions now entirely offshore and deliverables issued directly to Clients or through onshore oversight teams. Despite this, some specialist functions, like tax services, remain onshore due to their unique requirements and the value of local expertise. As Nicholson notes, “Having an onshore presence that Clients can access within their time zone can be seen as an advantage. Take Artega as an example, having end-to-end operations based in Australia is part of their value proposition”.

Outsourcing typically involves the transfer of functions and processes performed in-house to a specialist provider, leading to potential redundancies in roles. Nicholson points out, ” When fund managers and super funds outsource or change a service provider, it is a major change event. Many organisations simply “lift and shift” what they do today without taking the appropriate opportunity to reassess and improve how services are being performed through the design and implementation of a new operating model.

In selecting an outsourcing partner, numerous factors should be considered, including capabilities, alignment with your strategy, governance, financial strength and cultural fit. Nicholson emphasises, “The final decision often hinges on the cultural fit and the people involved. It’s crucial to have a healthy relationship with your service provider to ensure successful collaboration.”

In addition, firms need to determine the elements of their operations that will be outsourced and whether this will involve standard or bespoke requirements. Nicholson explains, “Providers often struggle with bespoke requirements and may resort to manual processes, which adds cost and risk. It’s advisable to simplify and standardise where possible.” Fund managers should look at experience and scale, gathering references to assess the provider’s suitability.

Understanding the provider’s operating model, including roles, responsibilities, and control environment, is essential. Nicholson highlights, “Matching the operating model of the fund manager or super fund with the service provider is crucial. Ensure clarity in the business requirements during the RFP stage to mitigate risks.”

Furthermore, whilst a fund manager or super fund can outsource activities to a service provider, Nicholson adds that they ultimately retain responsibility and accountability. Therefore, they must develop robust oversight and governance functions. It is crucial for them to have a clear understanding of the roles and responsibilities between service providers and fund managers/super funds. Regular service reviews should be conducted to ensure that service level agreements are being met and to measure the effectiveness of the operating model.

Ultimately, while outsourcing shifts some regulatory burden and controls away from an organisation. Nicholson cautions, “Regulatory responsibility remains with you, and failures of the service provider can impact your reputation. It’s important to choose a provider with a strong track record to mitigate these risks.”

Impact on Talent

The long-term effects of offshoring will impact graduates seeking to enter funds management. With positions at third-party service providers increasingly based offshore, junior candidates in Australia will face a more challenging pathway into the industry. Fewer positions will be available, and those that remain will often involve purely oversight roles of offshore teams or work within a heavily functionalised environment. This will likely affect the development of junior professionals aiming to grow their careers in the industry.

Possible solutions may include service providers developing rotational programs across functions, allowing staff to hone their skills across multiple teams. Drawing from my time recruiting in Ireland, Northern Trust in Ireland has implemented a rotational development program for junior staff, which has significantly benefited participants’ development.

Additionally, custodians could allow local staff in Australia to complete secondments in offshore locations to further develop and refine their skills.

The nature of positions has evolved and will continue to evolve, with overseeing and managing relationships with custodians and service providers being a key responsibility for investment operations professionals and there is now a definitive need for them to have a bespoke relationship management skillset. These positions are likely to remain in demand as fund managers seek to maintain investor confidence, manage risk, and adhere to regulatory compliance.

Outlook

Nicholson sees the evolution of outsourcing and dependency on service providers continuing to grow over the coming years with technology and data at the core.

Regulation will continue to demand changes, growing FUM will see more super funds build internal capabilities, smaller funds, with administration often run on spreadsheets, will reach critical decision points on whether to build their own capabilities versus outsourcing and there will be an increased need for automation to service growth in alternative asset classes.

However, Nicholson warns that “some service providers have implemented minimum threshold criteria when determining which RFPs to respond to and instances of selectiveness \increased recently. This will limit some options for funds whilst at the same time presenting opportunities for other service providers to grow market share”.

There has been talk about further consolidation in the Australian marketplace and the suggestion that there are too many players for the size of the market. “Therefore, we may see further exits akin to those of RBC and NAS”, Nicholson predicts.

The decision to outsource for fund managers and super funds needs to be carefully weighed, with firms needing to assess governance, servicing capabilities, financials/pricing, and engagement models. Ultimately, they must determine whether their outsourcing partner aligns with their culture and values.

From a service provider’s perspective, in an ultra-competitive environment, the growth of offshoring is likely to continue, which may further impact the development of investment operations talent locally in Australia.

While the investment operations landscape is shifting, it presents opportunities rather than challenges. As the marketplace evolves, so too will the positions of fund managers and service providers, giving rise to new roles in vendor oversight and relationship management. Professionals will adapt their skillset to align with this dynamic environment, ensuring continued career growth and relevance.

Get in Touch

Based in Melbourne and Sydney, Kaizen Recruitment specialises in financial services recruitment across funds management, wealth management, superannuation, investment consulting and insurance. If you’d like to discuss candidate career drivers and the current state of the market within the financial services recruitment landscape, feel free to reach out to us with your details below.

Like what you see?

Please feel welcome to join

Kaizen Recruitment’s mailing list