RIAA Conference 2024: ESG Growth Amid Tightening Regulations

Simon Gvalda; Kaizen Recruitment’s ESG, Sustainability and Responsible Investment recruitment expert had the privilege of attending the RIAA Conference 2024 in Sydney.

Below are some insights from some of the sessions that Kaizen attended.

Geopolitical Risks

It was great to see Hon. Gareth Evans AC KC‘s keynote speech for the conference on geopolitical risks the ESG and broader investment industry face. Responsible investors face many complex challenges and ESG risks. Below are some of the geopolitical risks as outlined by Gareth Evans that investors face:

Companies are expected to have supply chain transparency, it’s no longer okay to excuse this given some of the risks run very deep.

Responsible investors need to map their supply chain and engage with investee companies to ensure that the correct information can be found and reported back to investors.

Stewardship and Active Corporate Engagement

Deanne Stewart, CEO of Aware Super, delivered some great insights on how the role of investment stewardship and active corporate engagement has been elevated over the last 5 years.

Stewardship involves scenario mapping and looking at targets; and what companies are doing or not doing. Proxy voting is being used to ensure that governance is lifted and aligned from the director level down. Culture, conduct, remuneration and incentives play a keen role in developing culture and ensuring company values are aligned with ESG goals.

Deanne discussed what she believes the future holds for stewardship.

Forces Aware Super sees as driving ESG change, including risks and opportunities over the coming years:

- Meta trends – climate change, the rise of inequality across the globe, the rise of AI

- Continued increase of pension funds and sovereign funds across the globe

- 24/7 news cycle

- Getting more consistent standards and data

What will come from this:

- Greater active engagement

- Media and reputation management will become more relevant and important for companies and institutional investors

- Board oversight

Image courtesy of The Crop

Ethics in Ethical Advice? Financial Adviser Hurdles

When considering ESG issues when speaking with clients, financial advisers need to be aware of their own unconscious biases and not bring this into the clients’ decision-making.

As ESG issues become a great area of focus for clients, advisers need to know ESG issues to be able to provide advice or to outsource this to those that do. Many clients are becoming interested in these issues and are looking to incorporate them into their portfolios.

“Box ticking” may become an issue for advisers who choose not to fully engage with this as the focus on ESG grows which may indirectly influence whether clients engage with responsible investing.

The conversation is not about ethical investing, it’s about what legacy the client will leave.

Modern Slavery Risk and Reporting: “Where to from here?”

Human rights and modern slavery remain core ESG topics with around 50 million people currently in modern slavery circumstances.

Some of the global legislative and policy developments that are being implemented that will drive further developments in this space are:

- Human rights/sustainability due diligence and reporting legislation

- Import bans and border measures

- Human rights due diligence

- Modern slavery transparency legislation

Modern slavery is an externality that hasn’t been priced into markets due to its complexity and the lack of accurate data.

Greenwashing: A View from the Regulator

It was great to hear from Joe Longo, the Chair of ASIC, on their view on greenwashing, which they have been focused on over the last 2 years.

Their high-level view is that any statements regarding ESG claims must be substantiated on reasonable grounds. Where statements are made in marketing campaigns with little to no substance, that is when ASIC will likely want to find out more information. ASIC believes that introducing mandatory climate disclosures, product labelling, and the Australian sustainable finance taxonomy will help to reduce greenwashing.

Image courtesy of The Crop

ASIC emphasises the importance of net zero targets, scenario analysis, and creating transition plans.

The main types of misconduct they have identified in their enforcement efforts include:

- Factually incorrect net zero statements or targets

- Use of terms like carbon neutral, clean, or green without reasonable grounds

- Inaccurate labelling

A lack of transparency and misleading investors has never been acceptable, hence why greenwashing is in the sights of ASIC.

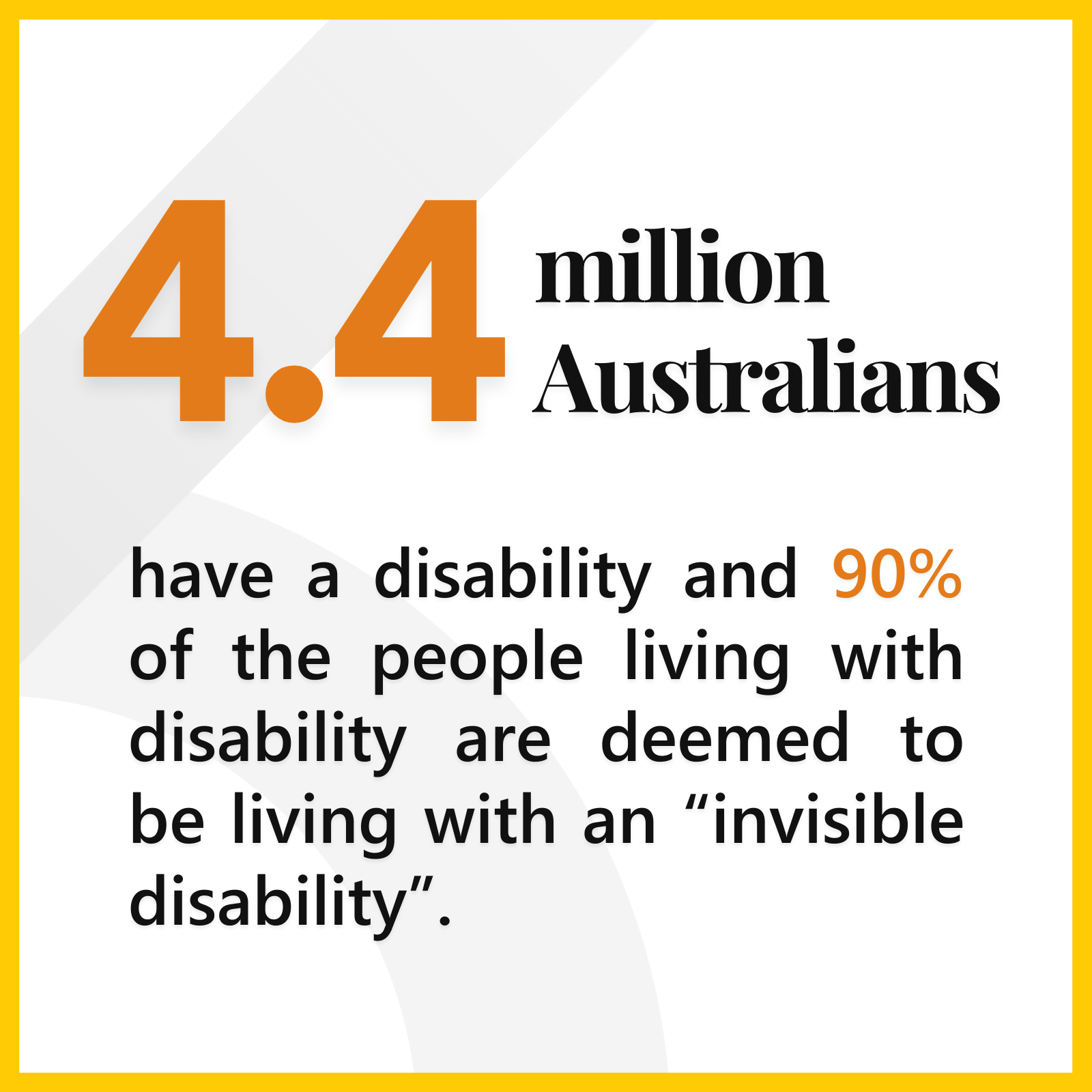

DE&I: The Case for Disability, Equity And Inclusion

One of the lesser talked about ESG issues is disability and it was great to have a spotlight shone on this area that affects around 17% of the Australian population.

People with disabilities are significantly underrepresented at the board and senior leadership level of companies.

Companies that demonstrate disability leadership generate 1.6x net revenue which means there is the potential for superior returns for investors in these companies.

There is currently a lack of data collection in workplaces regarding employees with disabilities, but there also needs to be support to start the conversation to ensure that people feel safe in identifying they have a disability.

There is limited data currently to know how many people feel comfortable to be open with regards to their disability with their employer. Many people with invisible disabilities are reluctant to self-identify.

When there is diverse leadership, we get a more diverse workforce. When senior leaders are open about their own disabilities it can help junior employees to feel safe in the workplace to start the discussion more broadly.

Conclusion

ESG is a massive area with many different areas, some of the other topics discussed included, diversity, AI, first nations, climate/net zero, education, data, impact, nature/biodiversity and more.

Thank you to all the conference speakers and also, we’d like to thank RIAA for putting on another incredible and informative conference and look forward to next year.

Get in Touch

Based in Melbourne and Sydney, Kaizen Recruitment specialises in financial services recruitment across funds management, wealth management, superannuation, investment consulting and insurance. If you’d like to discuss candidate career drivers and the current state of the market within the financial services recruitment landscape, feel free to reach out to us with your details below.

Like what you see?

Please feel welcome to join

Kaizen Recruitment’s mailing list