Paraplanners Are In High Demand – Get Great Qualifications And A Competitive Salary!

Seldom do good paraplanners stay in their role for a long period of time; most consider it as a stepping stone in their careers to move onto other roles with higher salary and bigger challenges. Recent trends demonstrate that most people take on the paraplanning role to create a strong foundation in the financial planning field, and utilise the experience to transition into other roles within the financial services industry.

Paraplanners are a backbone of financial advisers as they not only model and create the advice documentation in a form of Statement of Advice (SOA), but also take on other administrative responsibilities within the financial planning business. Other duties include:

- sitting in with financial planners during client meetings

- entering / updating data into softwares (Xplan, Midwinter and Coin)

- performing financial modelling

- conducting risk and compliance checks to ensure accuracy of data from fund managers

- reading research reports

- updating model portfolios

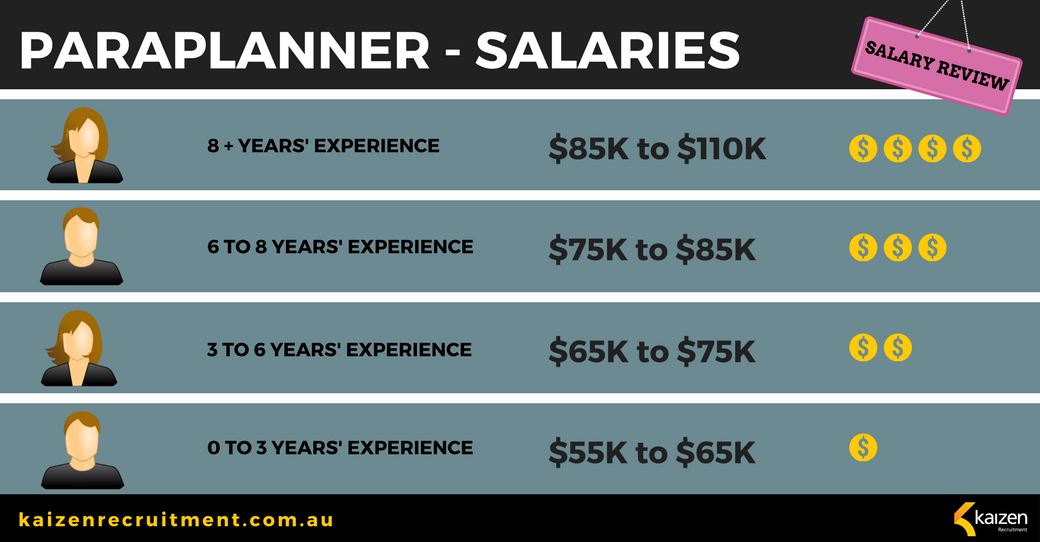

As the level of experience goes up, so does the complexity of strategy developed by a paraplanner. Most firms prefer paraplanners with experience in holistic advice. As seen in the image below, there is a positive correlation between the number of years of paraplanning experience and the range of salary. However, despite having more than eight years of experience, most paraplanners are capped at a salary of $110k.

Many paraplanners claim that their current position is a short-term plan, and expressed interest in the following career progressions within the financial services industry:

Financial advisory

Many financial planning firms would consider an internal promotion to an advisory role for a paraplanner as he or she is already aware of the business and its clients. It is safer to promote a paraplanner within the firm who is well aware of the firm’s risk and compliance processes, has invested interest in the growth of the firm along with his or her their own, and possesses necessary qualifications and training.

Risk and compliance

There has been a growing focus on risk and compliance roles with the recent regulatory changes taking place within the financial services industry. During my research, I have seen a number of previous paraplanners take on contractual roles in remediation management as they possess the required skillset. Some of the duties may include auditing and assessing client files according to regulatory or internal standards to ensure best interest duties are met by the financial adviser. This has left a candidate shortage across the market and is putting upward pressure on salaries.

Investment analyst

Many investment research houses prefer investment analysts with a paraplanning background as they have extensive writing experience and exposure to investment research reports, which is useful in writing managed funds and fund manager reports. In addition, the exposure to various asset classes and investment products gives them a stronger understanding of investment strategies and how different fund managers operate.

Employee’s willingness to learn and grow within the financial services industry, and the increasing demand in the roles listed above, are leaving paraplanning positions vacant, leading to an increase in the overall demand for this position.

Outsourcing paraplanning is a growing trend as it is perceived to be more cost-effective and efficient. However, only firms with effective online processes in place are able to take advantage of this practise. For outsourced paraplanners to write SOAs, in-house paraplanners must send across detailed summaries of client meetings, and amend them upon completion to make the SOAs more personable. Therefore, most firms prefer an in-house paraplanning team to enhance first-hand exposure to their clients and their needs, and to reduce the turnaround time to produce SOAs.

For those seeking to enter into the financial services industry, paraplanning is a good role to begin with, which could assist in steering your career to bigger and better directions in the long run.

How do I become a paraplanner?

Paraplanners are preferred to have a client service/assistant background but this is not an absolute requirement. Depending on the business, some client services/admin roles provide exposure to writing advice documents. This can allow candidates to develop valuable experience with their role while transitioning towards paraplanning over time.

Organised, strong attention to detail and the ability to multi-task and prioritise your workload are a must. You will be RG146 qualified, along with good verbal and written communication skills and passion to grow and develop within the financial planning industry.

Best Regards,

Simon Gvalda – Recruitment Consultant