A Diverse Workforce Starts With Diversity In Recruitment

Corporate Australia has been discussing gender diversity for many years, and the discussions have gone from being solely HR-driven initiatives to Boards under scrutiny. The argument for diversity in the workforce across a cross-section of facets is manifold, and not a new one. Other global markets have developed the maturity to incorporate addressing the intersectionality of diversity; in Australia, we are in comparatively nascent phases of multifaceted and intersectional diversity recognition, understanding and addressal.

At the International Women’s Day event in early March 2022, organised by CFA Societies Australia, Dr. Catherine Ball described gender diversity as the gatekeeper to other types of diversity. With a gender-diverse workforce, the likelihood of the workplace being seen as a safe space increases, allowing for more scope to attract different types of diversity. This is a crucial perspective to allow for the dial to be pushed further on additional facets beyond only gender. Overall increased diversity in an organisation also boosts its reputation making it a more attractive employer for candidates.

As McKinsey’s March 2020 report, Diversity Wins: How Inclusion Matters, cited, the business case for ethnic diversity on executive teams remains strong. It reported a 36% greater likelihood of financial outperformance by the top quartile to the bottom quartile of firms on cultural diversity, across research done in 6 markets (both developed and developing) over 4 years. It also highlighted that businesses in the top quartile for gender and ethnic diversity have a 12% higher likelihood of outperformance. ASX300 boards, as of 2023 data, have 90% Anglo-Celtic representation, which diverges from the general population trends of a growing proportion of the population being of Asian descent, and with little change to indigenous heritage directors either as per data presented by Board Direction.

As McKinsey’s March 2020 report, Diversity Wins: How Inclusion Matters, cited, the business case for ethnic diversity on executive teams remains strong. It reported a 36% greater likelihood of financial outperformance by the top quartile to the bottom quartile of firms on cultural diversity, across research done in 6 markets (both developed and developing) over 4 years. It also highlighted that businesses in the top quartile for gender and ethnic diversity have a 12% higher likelihood of outperformance. ASX300 boards, as of 2023 data, have 90% Anglo-Celtic representation, which diverges from the general population trends of a growing proportion of the population being of Asian descent, and with little change to indigenous heritage directors either as per data presented by Board Direction.

Educational diversity from the board level is being tracked in corporate Australia with mining/energy/technology skillsets trending upward, although accounting and finance still dominate. However, intersectional data show women directors tend to be much more qualified than their male counterparts. Extrapolating, data on educational diversity among women would be interesting to observe across broader swathes of the financial services industry.

Establishing diversity in our workforce is not only a feel-good early-stage initiative.

Diversity is a central tenet of establishing good ESG protocols within businesses and good governance practices and protocols that yield better outcomes for all – business output, staff engagement, morale and retention, and societal outcomes. As Kaizen noted from the Women in Boards 2024 event hosted by Women in Super, empirical evidence highlights that gender-balanced Boards perform better than their competitors as greater diversity on Boards leads to better commercial decisions and fosters stronger ESG cultures and practices. This will continue to bolster the support and demand for achieving diversity targets on Boards in the future.

As the CEO of CFA Institute, Margaret Franklin, cited in her speech at the International Women’s Day event hosted by CFA Societies Australia in March 2023, diversity is attraction, inclusion is retention and promotion is equity.

Minter Ellison projects that by 2030 there will be gender parity on Boards, and the Australian Institute of Company Directors reports that as of November 2021, there is no ASX200 company without women on its Board. The AICD Gender Diversity Report indicates that 35.6% of ASX 300 board seats are held by women, and 67% of ASX 300 boards have more than 30% female representation, an 80% jump from 2016. This is heartening to note that efforts are showing outcomes, albeit the majority of these women-held positions are non-executive directors. While a policy push may be elemental, corporations hold the power to help drive change and it is also our responsibility to continue to push to foster that within the industry.

As the corporate world increasingly adopts various initiatives to imbue a more diverse and inclusive culture in the workforce, many a time it begins with recruitment.

What is being addressed across diversity within the financial services industry today?

Diversity comes in a plethora of shapes and forms as we have established, with one key facet continuing to stand out in the Australian financial services industry – that of gender diversity. With research highlighting superior business results, productivity, and well-being of staff as a function of a diverse team, the push for gender balance within financial services has existed for some time with the focus remaining.

Particularly, we are seeing clients request strong female representation in investment teams along with some demand in investment operations and client services teams. Similarly, we have also had some clients express a desire for more male representation in female-dominated teams such as responsible investments; this latter occurrence in proportion however is an anomaly.

Kaizen has been conscious of tackling other biases that persist such as ageism, with consultations to clients on considering experience and mindset beyond age profiles, however, conversations coming from the industry are nascent. It is refreshing to hear some clients make enquiries on other facets of diversity and consciously push for their consideration, such as one funds management client asking for the conscious inclusion of neurodiverse candidates on a shortlist for a specific role.

What initiatives are being adopted to tackle diversity challenges, especially within recruitment?

DEI Policies and Fostering Culture

Clients progressively have formal policies and initiatives in place to meet certain diversity targets and encourage further female participation and development. This includes encouraging parental leave irrespective of gender and supporting greater flexibility of working from home (even before the current COVID-19 restrictions and with more adopting a view to extend thereafter). These policies are essential in their purpose to proliferate greater diversity. They provide a footing to support females through various stages of their careers to ensure that when they are up for senior roles, they are on par with males.

A large superannuation fund has also introduced access to grandparent leave helping promote age-diverse policies and also access to gender transition leave, pushing the dial on other facets of diversity, and inclusion.

To be able to retain and promote a diverse workforce, an amenable culture requires fostering, especially one that promotes psychological safety, that too in the continued hybridity of the work environment. As McKinsey’s Diversity reports reflect this may involve companies conducting targeted training across an organisation and encouraging cultural practices across the organisation, as it requires the entire workforce to facilitate a secure environment, and not only those who identify as diverse.

For example, as Leigh Sales AM, journalist and author, indicated in her speech at the CFA International Women’s Day 2023 event, the conversation with men on caregiving, and balancing work and family, needs to be normalised in the workplace to help eradicate gender-based biases and help make it a more accepting and equitable work environment.

As of 2023 data, at the present rate of change, it will take another 151 years to bridge the global gender economic gap at all levels and therefore deployment of DEI initiatives must bear in mind success factors for value generation and positive impact.

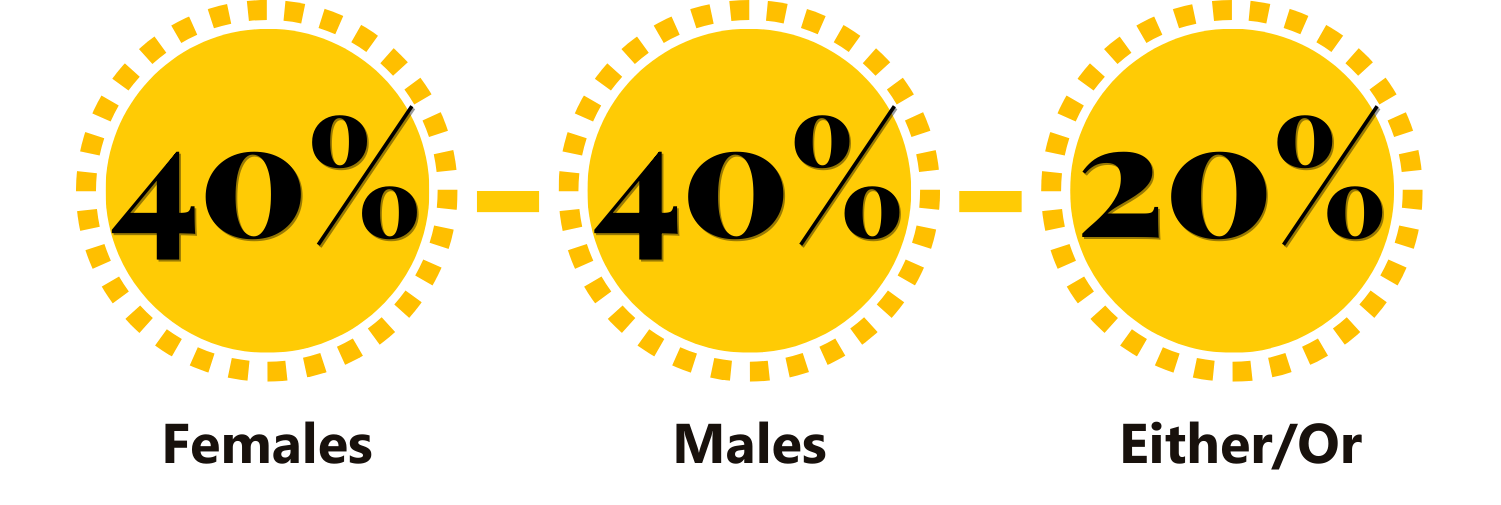

Gender-balanced Shortlists

To encourage greater diversity many firms require minimum or equal representation of female candidates on shortlists, with 50% being a target we seek to attain irrespective of mandates. Some have adopted a 40-40-20% quota of 40% female, 40% male and 20% either/or. Much of the time it is possible to meet client requirements and we are up for the challenge. As a specialist agency, we know how and where to find talent.

To encourage greater diversity many firms require minimum or equal representation of female candidates on shortlists, with 50% being a target we seek to attain irrespective of mandates. Some have adopted a 40-40-20% quota of 40% female, 40% male and 20% either/or. Much of the time it is possible to meet client requirements and we are up for the challenge. As a specialist agency, we know how and where to find talent.

Gender-neutral and Customised Ads

To mitigate prospective candidates from self-deselecting, the adoption of gender-neutral ads across financial services has emerged over the last couple of years as semantics can influence or deter candidate applications.

Academic studies indicate that not only women are less likely to apply for ads using more masculine words, but it generates a feeling of a lesser likelihood of belonging, and also the perception generated about the workplace in both male and female candidates alike is that of it being more male-dominated.

Studies indicate women self-deselect themselves from positions and refrain from applying if they do not meet 100% of the qualifications, whereas men would apply if they meet 60%. This is exacerbated further for more advanced and higher-paying positions.

How ads are curated is an important brand representation for both ourselves as recruitment partners and clients, and is key to ensuring the right talent are not deterred from applying.

Blind Shortlists

While blind shortlists have existed for some time, we have seen an increase in requests, with the redaction of a combination of personal identification factors like names and schooling. This is to alleviate bias across gender, ethnicity, and nature of thought from educational cohorts.

Sometimes blind shortlists may not be successful in fulfilling the desired diversity outcomes, especially in cases where there is a lack of depth of females in the talent pool to begin with and clients may inadvertently only select male candidates to progress to interview. Ultimately, this emphasises that it is about the best skills and team fit, and as recruitment partners, how we can consult clients about the right fit and meeting their diversity requirements.

Transferable Skills

Many times, hiring manager biases creep into the recruitment process to find candidates from certain educational cohorts, specific industry experiences or those akin to themselves; which makes the search for diverse talent harder if there is a dearth of diversity in the talent pool. While firms are increasingly adopting practices to eliminate bias, there is more that can be done to consider candidates with suitable transferable skills to broaden the pool of candidates to consider overall, and especially to help enhance diversity, without the loss of quality outcomes.

On the plus side, bringing in more transferable skills helps create a pathway for more scope for development in the role, which in turn can aid retention. As Kaizen has regularly surveyed its target market, career development consistently ranks in the top two reasons for candidates to entertain opportunities along with flexibility; above salary.

Kaizen Recruitment for example has frequently partnered with a respected fund manager to recruit multiple female investment analysts, to help build a pipeline of future female talent, one which enabled the consideration of a broader skill set of talent, so far as they had the right quant skills, passion for and an understanding of investments, and the right attitude and aptitude to learn.

Curated Interview Panels

One progressive superannuation firm explicitly in their recruitment protocol mandates each interview be conducted with a panel of two with a gender balance and diversity across tenure, skillset, and backgrounds, equipped with interview guidelines to minimise bias in the interview process to ensure the best person is selected for the job.

Median Salaries and Transparency

As per data from Australia’s Workplace Gender Equality Agency (WGEA), irrespective of the methodology utilised to calculate the gender pay gap, it underscores that it exists. Its reports show that it could vary between 12 – 21.7% based on how pay is calculated, however, it continues to be a significant problem in 2024. In Kaizen’s experience, there has been no empirical evidence of a deliberate gender-based difference in offering a candidate a salary package within the non-banking side of financial services, however, data indicates financial services as a whole constitute carrying a large pay gap, with some of the big four banks making to the top 10 organisations with a high gender pay gap and the industry is one of the top four industries within which 90 per cent or more employers have a gender pay gap in favour of men.

Some of our superannuation clients present the salary of an offer as a median amount for the role, along with a range, agnostic of gender, at the outset of a recruitment process. This levels the playing field in knowing where the rest of the team’s salaries fall and enables a more meritocratic negotiation in the final salary offer.

Conclusion

Kaizen is committed to its contribution to the Australian financial services industry’s efforts to enhance industry and social outcomes and is a strong advocate of diversity. It is Kaizen Recruitment’s assurance that all qualified applicants receive consideration for job opportunities without regard to gender, race, colour, religion, age, disability, sexual orientation, gender identity or expression, genetic predisposition or career status, veteran, marital status, or any other status protected by law. We will continue our endeavours to understand, educate and enhance multifaceted diversity recognition and intersectionality, as this Minter Ellison report presents, improvements have been achieved in corporate Australia, but there is a way to go, and hence, seek the partnership of industry bodies, client organisations and our network at large to continue to advance both micro and macro initiatives.

To understand the impact that the current initiatives are having on diversity in financial services recruitment Check out part 2, State of Diversity: Year-in-review, where we reflect on the state of the market and share the trends we’ve noticed.

Get in Touch

Based in Melbourne and Sydney, Kaizen Recruitment specialises in financial services recruitment across funds management, wealth management, superannuation, investment consulting and insurance. If you’d like to discuss candidate career drivers and the current state of the market within the financial services recruitment landscape, feel free to reach out to us with your details below.

Like what you see?

Please feel welcome to join

Kaizen Recruitment’s mailing list