Navigating the Cost-Out Business Model – An Interview with Brett Jollie

Darragh Cleary, who leads Kaizen Recruitment’s Investment Operations and Accounting division, recently met with Brett Jollie to discuss the growth of firms adopting “cost-out” strategies. Brett is the former Chief Executive of Aberdeen Asset Management Australia (“abrdn”), where he spent 23 years across a range of functions and had strategic oversight of abrdn’s Australian business. He is currently a Partner at KONU Consulting, a specialist investment and wealth management consulting firm.

Introduction

Amidst economic fluctuations and industry-specific challenges, organisations continuously seek methods to streamline operations and boost productivity. These initiatives can touch all parts of a business. From a recruitment standpoint, we have seen this in the form of several role restructurings and redundancies across the funds management industry. But what exactly are cost-out strategies, and why are firms increasingly turning to them?

What are “Cost-Out” Strategies?

At its core, cost-out strategies encompass initiatives aimed at reducing overall operating expenses within a business. In essence, these strategies strive to enhance productivity by optimising resources and processes, which should result in increased profits/profit margins. As Brett Jollie, outlines, “Cost-out strategies refer to programs that seek to reduce the overall operating costs within a business, while simultaneously focusing on strategies that reduce the cost per unit of output, ultimately enhancing the productivity of a business”.

Drivers Behind Cost-Out Strategies – “Why now?”

The rationale for firms adopting cost-out strategies can be attributed to macroeconomic and industry-specific factors.

Macro Factors:

The current macroeconomic environment, with increased interest rates and a contraction in economic growth, places significant pressure on the cost structure and revenue-generating ability of businesses. Jollie highlights, “In the current environment, the cost of running a business has increased, and in the absence of increased revenue growth this results in a contraction in profit margins. Firms must resort to cutting costs and/or improving productivity to maintain margins”.

Industry Specific

Within superannuation and funds management, unique challenges have intensified the need for cost optimisation.

Two evident factors in superannuation have resulted in firms seeking to drive down costs. Jollie explains, “Superannuation firms face ongoing pressure from government and policymakers to reduce costs, coupled with fierce competition to retain existing members and attract new members in an environment where fees are highly visible”. The consolidation of the superannuation industry over the past few years can be attributed to this.

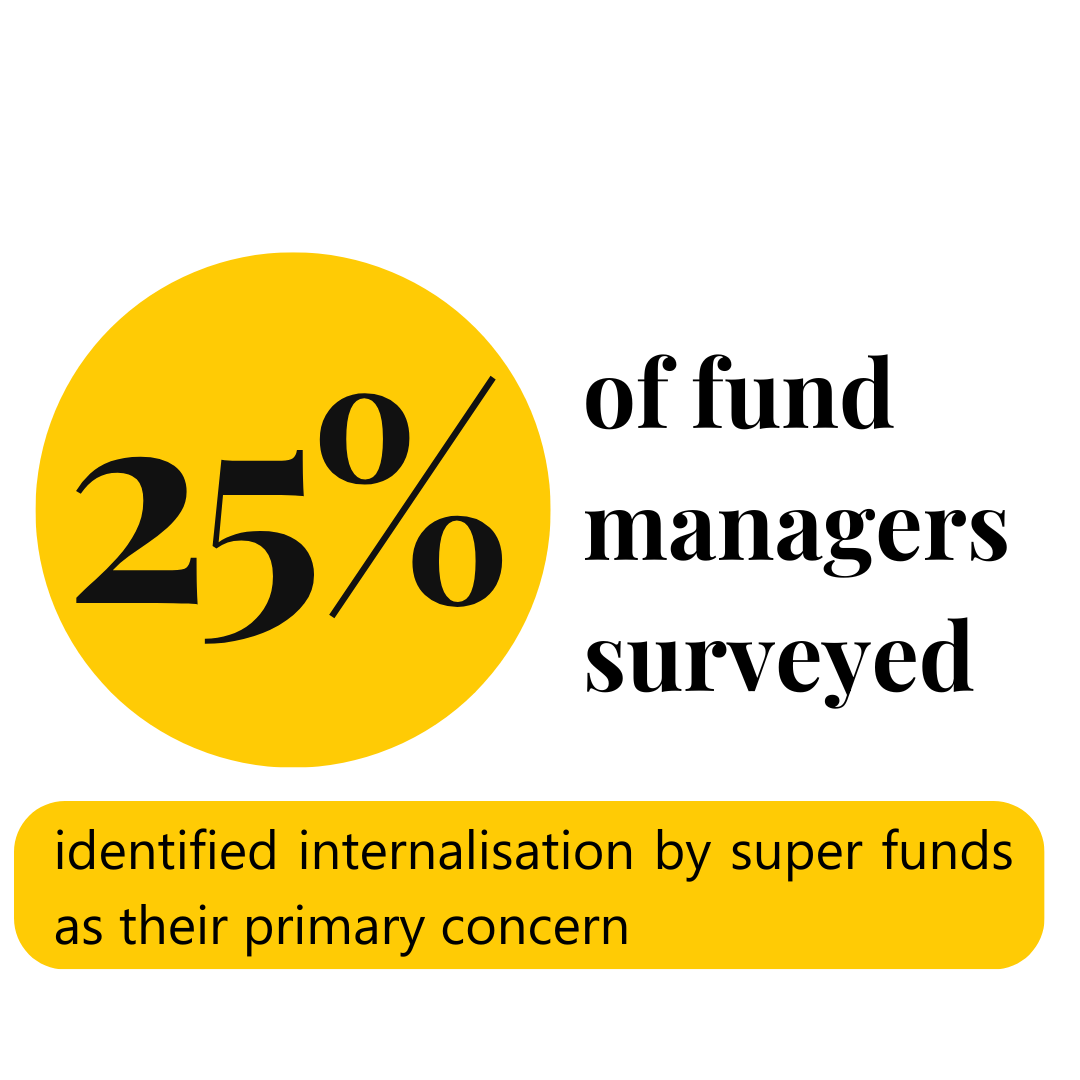

Within funds management, fund flows into traditional, actively managed strategies have fallen in recent years due to extended underperformance by active managers, market volatility, declining investor sentiment, a shift to passive investment strategies and in-sourcing by asset owners (in a recent survey by Frontier, 25% of fund managers surveyed identified internalisation by super funds as their primary concern).

As a result of these headwinds, actively managed strategies globally experienced net outflows of A$42 billion (US$27.2B) in 2023 according to Calastone’s Global Fund Flows Report. Jollie explains, “These dynamics have had an immediate and lasting impact on active managers’ revenue and profits. To protect margins fund managers have been forced to cut costs and improve productivity”.

Fortunately, the opportunity to reduce costs and increase productivity has never been greater – largely due to technological improvements and the ability to leverage the productivity gains that ensue. However, firms must be diligent. Jollie highlights, “In a very competitive industry, it is incumbent on investment firms to continuously search for cost savings/productivity gains”.

Cost-Out: Strategic Areas of Focus

In its most basic form, companies need to identify the expenses that are not effectively contributing to the operations and/or growth of the business. However, Jollie argues that “the major benefits will come from productivity gains” and there are several critical areas that warrant focus, including governance and organisational structure (how a business is run), operating models, commercial arrangements technological advancements, and product and distribution.

1. People – Organisational Structure, Governance, Teams, Individuals

Jollie emphasises the importance of scrutinising the governance and organisational structure of a business. Firms need to assess factors such as the effectiveness of decision-making structures, bureaucratic hurdles, the necessity of layers within the hierarchy, collaboration, and empowerment across teams, and whether individuals are appropriately skilled and adequately remunerated.

2. Operating Model

Firms must carefully consider the division between in-house operations and outsourcing to third-party specialists. Jollie emphasises the importance of “regular evaluation to ensure these external partners meet targets without requiring constant intervention”. Are the service providers contributing to lower costs and increased productivity? For in-house functions, firms should assess whether existing processes can be streamlined or standardised more effectively to enhance scalability.

3. Technology and Systems

As technology continues to evolve, it provides firms with opportunities to enhance automation and productivity. This, in turn, enables firms to deliver more with the same level of output, thereby increasing efficiencies. For Jollie, “The choice of technology, and price you pay for it, is a critical decision”. Firms must seek to understand what functions can be automated, how effective their current systems are at automating work processes and if there are better alternatives.

4. Commercial Arrangements

Jollie points out that “the cost for most investment services (custody, admin, registry, audit, etc) has been decreasing over time”. As a result, investment firms should assess whether better terms can be negotiated with service providers as firms locked into fee schedules negotiated years ago may no longer be paying market-competitive rates.

5. Product and Distribution

Firms need to assess whether they have effective processes in place for managing their product suites across the entire product lifecycle, from ideation to launch, to ensuring a product remains relevant over time. Jollie argues, “Many investment firms don’t manage this process well, with product proliferation rife”. This adds to the costs of a business without necessarily adding to revenue. Jollie highlights, “Many firms do not assess the profitability of a fund in a disciplined fashion, which often results in loss-making funds remaining open indefinitely when the prudent thing would be to close or restructure.” It is essential that firms have a process for monitoring funds to ensure they perform for investors and take action if the fund isn’t performing.

The client channel and investment/product strategy must also be considered. There will be different fee and revenue structures associated with running different products & strategies, as there will be with selling into different channels. Jollie points out, “it may not make sense to focus on certain products, strategies or client channels”.

Considerations

Several considerations must be taken into account when implementing cost-out strategies. Firstly, firms should exercise caution against slashing expenses too aggressively without corresponding gains in productivity, as this could hamper future growth prospects significantly.

Moreover, decisions to reduce staff must be carefully weighed, considering the potential need for rehiring when growth resumes. From a recruitment perspective, firms must appreciate recruitment and retraining expenses. In addition, in a competitive market firms may find themselves paying a premium to recruit external talent. Beyond monetary costs, Jollie adds, “Firms must also recognise the loss of experience and intellectual property, and the impact on client relationships, morale, and company culture”.

Additionally, Jollie points out that when engaging external advisers or consultants for cost-cutting advice, it’s essential to avoid arrangements where their compensation is tied to the amount of cost reduction achieved as such arrangements may incentivise excessive cuts without considering potential repercussions. Instead, he argues that firms should align the interests of consultants by exploring alternative remuneration models that prioritise sustainable cost management strategies.

Conclusion

In conclusion, while many firms diligently manage their costs amidst the current economic climate, there may still be ample opportunities for significant efficiency gains through effective cost-management strategies. However, it’s essential to approach cost-cutting measures with caution, prioritising strategies that not only yield short-term savings but also drive long-term productivity gains.

Jollie finishes with some advice for firms looking to adopt cost-out strategies: “Effective implementation of cost-out strategies usually requires cross-functional collaboration, clear communication, and ongoing monitoring to ensure sustainable cost reduction and long-term business success”.

Get in Touch

Kaizen Recruitment specialises in financial services recruitment across funds management, wealth management, superannuation, investment consulting and insurance. We are based in Melbourne and Sydney.

If you’d like to discuss candidate career drivers and the current stats of investment operations within the financial services recruitment landscape, please reach out to Darragh at +61 478 350 003 or get in touch with our team below.

Like what you see?

Please feel welcome to join

Kaizen Recruitment’s mailing list