Investment Analyst Salary Guide 2024

Kaizen Recruitment uses in-depth market knowledge to help guide and consult our candidates and clients within the financial services industries. To ensure this data reflects recent changes and trends, our Senior Recruitment Consultant, Jeremy Easy, gathers insights from our network of investment analyst professionals.

Introduction

Demand for Investment Analysts in Australia remains robust, particularly among alternative investment managers and superannuation funds that are actively expanding their internal teams. Analysts with 2-5 years of experience and specialised expertise in asset classes such as private debt, infrastructure, and private equity are especially in demand.

Despite a growing candidate pool fueled by recent immigration and corporate restructuring, roles requiring niche skills—such as alternative asset exposure, advanced financial modeling, and business intelligence proficiency—remain difficult to fill due to the limited availability of suitably qualified professionals. As diversity becomes a priority, firms are also emphasising the recruitment and retention of female talent in front-office roles.

Given these talent shortages, employers are expanding their strategies to attract top candidates, including offering increasingly competitive salaries, enhanced benefits, and other appealing incentives. Likewise, candidates are prioritising opportunities that offer strong career development, diversity initiatives, and work-life balance. This guide offers insights into current salary trends, showcasing competitive pay rates across graduate, analyst, and senior levels in investment management.

Industry Overview

Over the past year, investment management in Australia has experienced significant changes, driven by evolving hiring trends, shifting salary ranges, and increasing demand for specific skill sets.

The internalisation of investment management within superannuation funds has spurred a rise in Investment Analyst roles across broad asset classes. According to LinkedIn data, over the last 12 months, major superannuation funds have reported an average of 10% growth in Investment Analyst and Senior Investment Analyst positions.

Meanwhile, smaller fund managers outside of sectors like Infrastructure, Private Debt, and Private Equity have faced challenges due to internalisation. While these sectors have maintained consistent growth, other smaller firms have lost mandates, leading to stagnation or a decline in growth.

Several factors have reshaped the hiring landscape within the financial services. Particularly for the investment analysts, the market is driven by the following factors:

Niche Skill Demand

Despite a more competitive market, candidates with niche experience in asset classes including infrastructure, private debt, and private equity alongside strong quantitative capabilities remain in high demand. Proficiency in Excel, financial modelling, and exposure to business intelligence or coding tools (e.g., Python, Power BI) are particularly valuable.

Increased Candidate Pool

Immigration surges, redundancies, and corporate restructuring have led to a larger pool of candidates but fewer available opportunities. Although there has remained a lack of supply of candidates with niche and role specific skillsets.

Economic Factors

The job market has re-balanced to resemble pre-pandemic conditions, becoming far less candidate-driven.

Diversity Initiatives

Diversity remains a key focus within investment management. According to Future IM/Pact, female investment analysts make up just 28% of the workforce, whilst this is up 4 percentage points compared to a diversity study conducted by Mercer 7 years ago, many organisations still have a strong focus on empowering and nurturing female talent to increase the diversity within investment teams and promote pathways to leadership roles.

Salary and Benefits

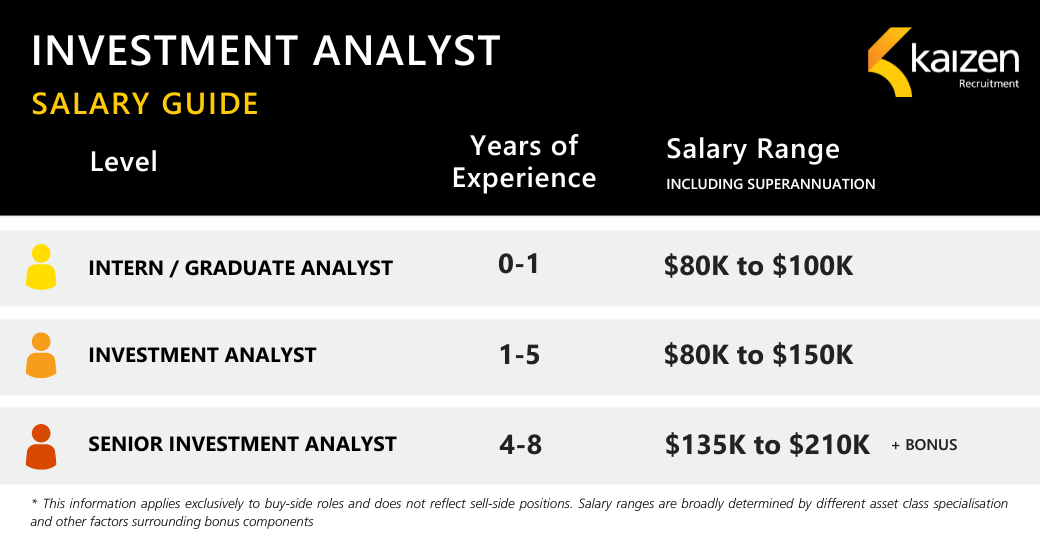

The below table shows the average salary ranges of investment management professionals from the graduate level up to the Senior Analyst level.

Company Type and Size

Boutique Firms vs. Large Institutions:

Boutique firms might offer higher salaries to attract talent, while larger institutions could provide more comprehensive benefits packages.

Startups vs. Established Companies:

Startups might offer equity or performance-based incentives in lieu of higher base salaries, whereas established firms could provide stability and higher base pay.

Superannuation vs Fund Managers:

Superannuation firms often do not have bonus structures for Analyst level positions, leading to higher base salaries in comparison to Fund Managers and other alternative firms.

Geographical Variations

Industry Presence: Certain industries might be more prominent in specific regions, impacting the demand and compensation for investment analysts.

Education and Certifications

MBA/CFA/Professional Certifications: Advanced degrees and certifications such as CFA (Chartered Financial Analyst) or CPA (Certified Public Accountant) can significantly impact salary levels and career progression.

Performance-Linked Compensation

Bonuses and Incentives: Performance-based bonuses can constitute a significant portion of an investment analyst’s total compensation, especially in the finance industry.

Profit-Sharing and Commission: Some firms offer profit-sharing, or commission structures based on individual or team performance.

Overview of Seniority Levels

Intern / Graduate Analyst: 0-1 year of experience

Intern / Graduate Analyst: 0-1 year of experience

Graduate programs in major superannuation funds and large fund managers have long provided opportunities for emerging professionals to gain exposure to different business lines and asset classes. These programs are instrumental in cultivating young talent and fostering professionals who align with the company’s culture and growth strategies.

Graduate salaries can vary depending on the complexity and size of the role and organisation. While some positions may offer salaries between $60,000 and $70,000, the typical range for graduate salaries falls between $80,000 and $100,000.

Graduate positions are viewed as strong development opportunities for professionals to gain initial exposure and experience, at times in the form of rotational programs. These programs typically do not have a bonus component.

Investment Analyst: 1-5 years’ experience

While there has been an increasing trend of firms hiring at a junior or graduate level, there continues to be strong demand for Analysts with 1-5 years of experience.

A notable trend over the past year has been the rise in remuneration at the top end of this level, while typical salary ranges are between $100,000 – $140,000 firms have become more willing to compensate Analysts with niche experience or skillsets including alternative asset exposure and strong quantitative capabilities between $150,000 and $160,000. These Analysts, though still in the earlier stages of their careers, are expected to hit the ground running and bring immediate value to their organisations.

This demand spans all asset classes but has been more prevalent within alternative and unlisted investments, with a consistent number of roles focusing on both direct investments and fund-to-fund solutions. Analysts at this level are typically required to, at a minimum, maintain financial models and possess strong Excel skills.

Senior Analyst: 4-8 years’ experience

Demand for experienced Senior Investment Analysts remains high, especially in firms requiring professionals capable of immediately adding value, taking on extra responsibilities such as portfolio management. Analysts at this level are often expected to have a strong baseline experience and typically will have a focus on further developing asset class exposure. Although these positions are still typically focused on individual performance and value add, mentoring junior analysts can be a small part of role responsibilities, particularly in smaller funds.

Senior Investment Analyst salaries generally range from $135,000 to $210,000, depending on experience, size of the organisation and complexity of the role. Specialist and highly quantitative roles are typically compensated at a higher range. At this level, bonuses can become a significant component of compensation, typically ranging from 15-30%, with some cases reaching up to 40%. This is also the entry point where some superannuation funds offer performance-based bonuses.

Conclusion

The Australian investment management sector continues to evolve, with a growing demand for analysts who possess strong technical and quantitative skills, particularly in Excel and financial modelling. Asset class specialisation remains a key driver in hiring trends, with competitive salaries reflecting the value placed on professionals who can bring immediate impact. As firms focus on fostering diversity and talent, the importance of specialised skill sets will continue to shape the industry’s future.

DOWNLOAD SALARY GUIDE AS PDF

Get in Touch

Based in Melbourne and Sydney, Kaizen Recruitment specialises in financial services recruitment across funds management, wealth management, superannuation, investment consulting and insurance. If you’d like to discuss candidate career drivers and the current state of the market within the financial services recruitment landscape, feel free to reach out to us with your details below.

Like what you see?

Please feel welcome to join

Kaizen Recruitment’s mailing list

Intern / Graduate Analyst: 0-1 year of experience

Intern / Graduate Analyst: 0-1 year of experience