Investment Analyst Recruitment Program – VFMC

Kaizen Recruitment has been committed to helping drive enhanced diversity outcomes within the financial services industry in Australia for many years and envisions continuing to advocate to broaden the lens on diversity. As one of the only recruitment firms driving, measuring and reporting on diversity initiatives and outcome metrics, we have had the opportunity to partner with multiple prestigious fund managers and superfunds to help them achieve their diversity goals.

The Mandate

Kaizen Recruitment has partnered with VFMC on multiple mandates to help enhance their gender diversity, especially within their investment team. In addition to mid to senior level engagements, we have run three investment analyst programmes for VFMC as part of their drive to build a diverse pipeline of talent within their investment team to drive enhanced outcomes into the future and develop a cohort of future leaders.

In each of the three programmes, we were required to shortlist 8 candidates for each role, with a net positive diversity quotient, especially on gender.

Our Recruitment Process with VFMC

Investment Analyst positions are highly sought after. Given the high barriers to entry into investments, and the low conversion rates of candidates making career changes, we wanted to ensure that all had as equal an opportunity as possible.

We ran a comprehensive, multi-faceted recruitment process for each program, by actively soliciting interest from the market using a targeted campaign to draw in diverse talent from across our database, LinkedIn network, and the broader market. The processes were highly competitive, in which we adopted proactive strategies to consider candidates of varied backgrounds, with relevant transferable skills. While each program had psychometric testing, in conjunction with case studies added to the interview process, we also organised an assessment centre for the first program. This included assessing performance in group discussions, team-oriented activities, and panel interviews with both VFMC and Kaizen stakeholders, balanced as best to mitigate bias.

As part of the process for the program in 2022, Kaizen helped co-host a breakfast

mentoring session with VFMC’s investment leaders and invited a targeted audience of candidates from diverse backgrounds. The objective was to help aspirational investment analysts to gain a better insight into the world of investment management as well as allow VFMC the opportunity to highlight their culture and encourage diverse candidates to consider growing their careers within the funds management industry.

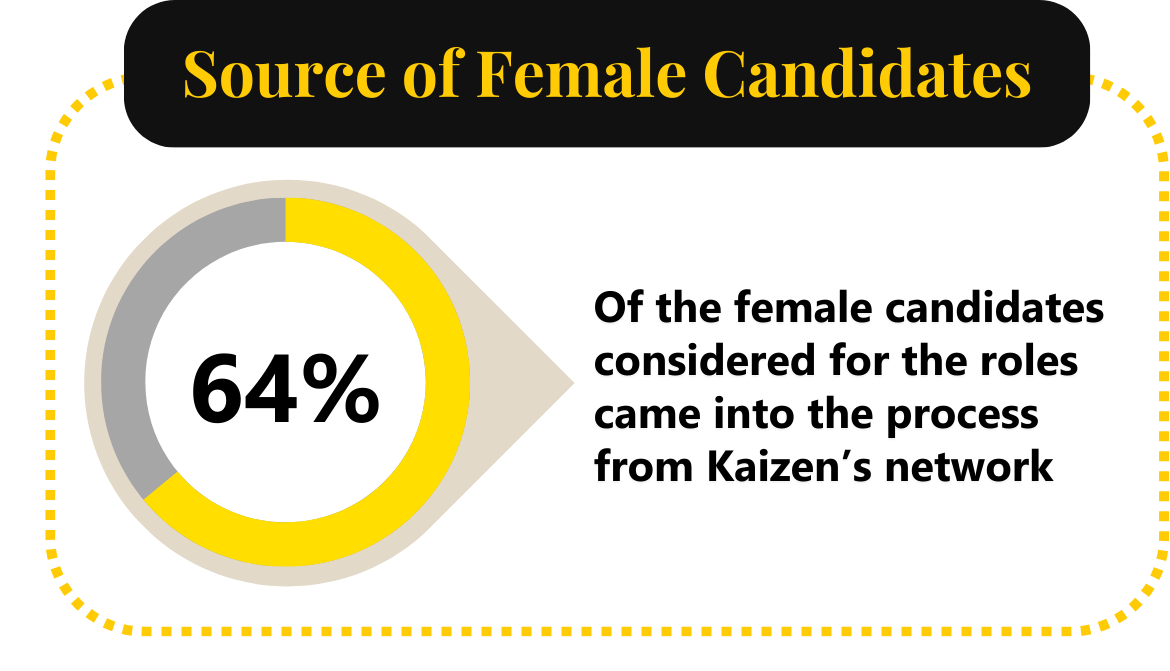

On analysing our data, 64% of the female candidates considered for the roles came into the process from Kaizen’s database, network and our brand.

Recruitment Outcomes

Close to 700 candidates were considered for each Investment Analyst program. In 2022, the positions ranged across asset classes including property, debt, equities and portfolio implementation, and investment stewardship, with 2023’s program focusing on portfolio risk, infrastructure, and investment operations.

The successful candidates are gender diverse and come from different ethnicities – Australian, Asian and South Asian. They are also from various professional backgrounds and levels of experience, including recent graduates – one with interning experience at a super fund, one from outside of the financial services industry with a strong quantitative background, one transitioned from investment operations into the investments team with stellar CFA results, and another from client services, feats aspired by many but very hard to crack through to.

From an education perspective, they all demonstrated strong academic rigour in their respective areas of qualifications, with it being spread across commerce/financial mathematics/computational sciences; the majority have completed their master’s degrees.

The commonality in their diversity is their mindset and commitment to the industry; with strong personal values of integrity, humility and confidence, with an identifiable interest in investments and a curious mindset wired to learn.

As part of the success story highlighting VFMC’s culture and values, it has been excellent to see that one of the successful candidates in one of the Analyst roles in each of the 2019 and 2022 programs was an internal VFMC staff member. The internal candidates were considered as part of the holistic recruitment process, and this is a testament to an organisation supporting the development and growth of their internal talent.

While it is heartening that the feedback from our placements is highly positive, Kaizen Recruitment is also privileged and proud to have had the opportunity to partner on these initiatives to help lay the foundations for strong future teams given the medium-term investment of two years that VFMC will put into the analysts’ learning and development and to deliver diverse outcomes across the multiple facets of gender, cultural, cognitive and educational diversity.

Get in Touch

Based in Melbourne and Sydney, Kaizen Recruitment specialises in financial services recruitment across funds management, wealth management, superannuation, investment consulting and insurance. If you’d like to discuss candidate career drivers and the current state of the market within the financial services recruitment landscape, feel free to reach out to us with your details below.

Like what you see?

Please feel welcome to join

Kaizen Recruitment’s mailing list