Funds Management Distribution Salary Guide and Market Update June 2024

Changing Landscape of Funds Management Distribution

The landscape of funds management distribution is undergoing significant change, particularly within the institutional channel, driven by the consolidation of superannuation funds. This trend reflects a broader industry movement towards efficiency and scale. Institutions are increasingly prioritising wholesale channels, focusing on wealth management firms and high-net-worth clients. Additionally, the growing emphasis on family offices highlights their unique requirements and expanding influence within the investment landscape.

With the rise of new investment channels, particularly Exchange-Traded Funds (ETFs), and the growing direct-to-consumer approach, there is a clear demand for experienced business development managers. Their established client networks are crucial in navigating these evolving distribution strategies and ensuring firms can effectively engage investors across multiple channels. Their expertise and connections are indispensable in adapting to the competitive and dynamic environment of funds management distribution.

We recently hosted our Funds Management Distribution Executive Round Table for 2024 to further explore these trends.

LEARN MORE FROM THE ROUND TABLE DISCUSSION

Salary and Additional Benefits

We conducted our 2024 Funds Management Distribution Salary Survey earlier this year, receiving responses from a significant number of funds management distribution professionals across Australia. We then benchmarked these results against our existing database.

*These figures represent base salary inclusive of super although does not include car allowances or potential bonuses of up to 100% of salary

One of the most common questions this year is about funds management distribution professionals’ bonuses. We have identified that retail/wholesale on average was 20%-40% of base salary depending on performance. On the other hand, institutional on average was 50%-60% of base salary depending on performance.

External market pressure on funds management firms, especially those with traditional strategies, has proven tough to raise capital and we noted a trend where several distribution professionals, unfortunately, were not able to meet their targets, hence bonuses in some cases have not been as lucrative as previous years.

Additional Benefits Received (Excluding Salary or Bonus)

Despite the challenges, quite a few distribution professionals that received 80%-100%+ of their base salary as a bonus in 2024, although this was reflective of high performing funds and alternative strategies in private markets. Almost half of the funds management distribution professionals surveyed have additional benefits including education allowance, followed closely by a health and wellness budget. Additional annual leave, travel and car allowance were also included in salary packages.

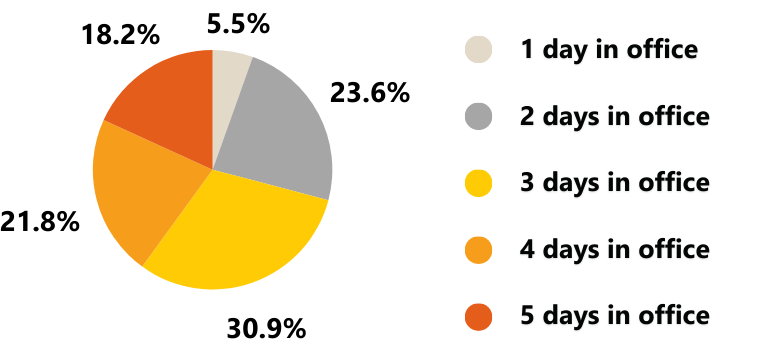

Days in Office vs. Work from Home

Flexibility remains key for funds management distribution professionals. Whilst we appreciate there will be a split between working in the office and being on the road, 3 days a week in the office is the most common for funds management distribution professionals in 2024.

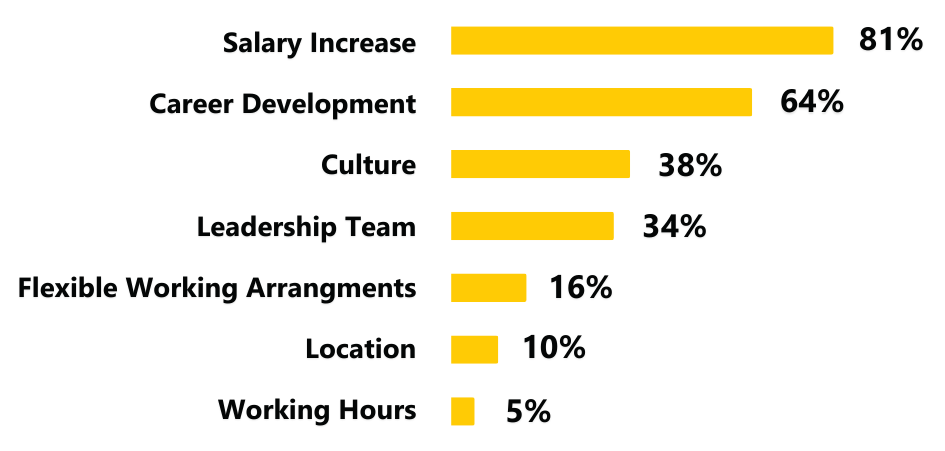

Key Motivators for Job Change in 2024

Multiple factors play into the decisions of professionals to consider a change in roles, one of which is the rising cost of living. It is no wonder that a salary increase is the primary reason (81%) for professionals to consider a different job.

While base salaries are comparable across competing firms, the real competitive edge lies in bonus potential and additional benefits within the employee value proposition (EVP), such as health and wellness programs and education allowances.

Career development emerged as the second-highest motivator, closely followed by firm culture and having a supportive leadership team. If you are looking to hire new distribution staff, ensure your employee value proposition is compelling and clearly communicated, as it plays a crucial role in attracting top talent in this competitive market.

Retail vs. Wholesale: Channels and Products

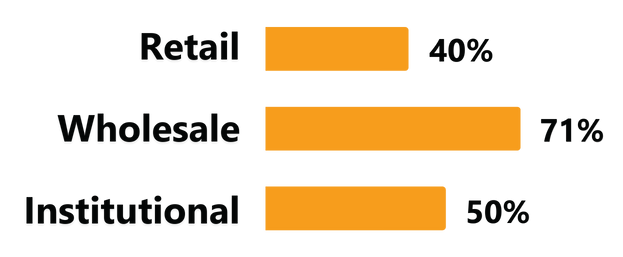

Product Distribution Channels

As a result, retail and wholesale distribution teams are expanding to cover the larger market, necessitating more personnel to service these channels effectively. In contrast, institutional teams are becoming leaner. In many cases, a fund may only employ one or two people to cover the entire Australian institutional market, reflecting a strategic shift towards efficiency and specialisation in this segment.

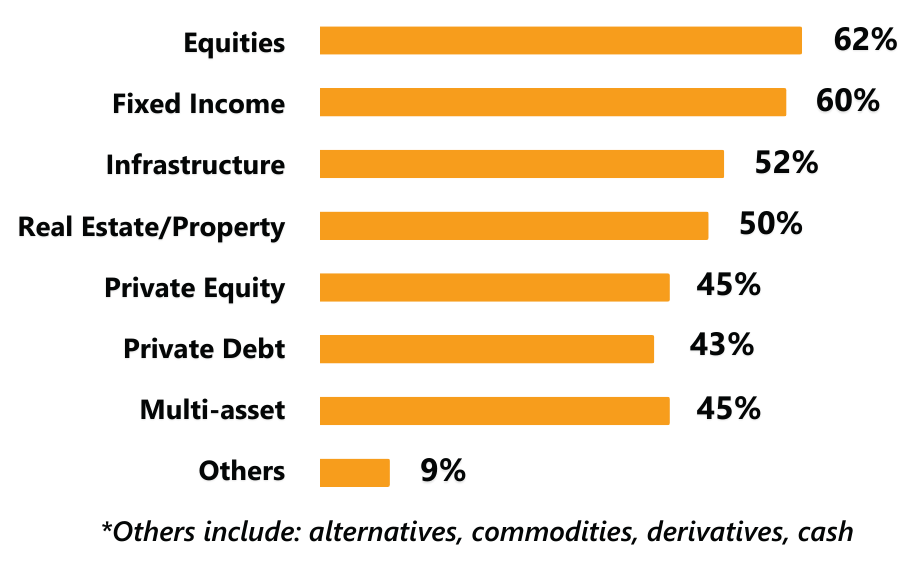

Investment Products: Asset Class Exposure

It may not be a surprise that equities and fixed income remain the primary asset classes sold across retail, wholesale, and institutional channels. This dominance is expected given their traditional role in investment portfolios. However, these investment strategies are under scrutiny. To survive in a crowded market, fund managers need a compelling value proposition, strong performance, and a solid brand and reputation. Asset owners increasingly manage these strategies in-house, especially superannuation funds. Additionally, these strategies are often the first to be transitioned to passive management by wholesale and retail investors.

Infrastructure and real estate are close followers in popularity, indicating a strong demand for tangible assets that can offer stability and potential for long-term growth. However, a significant surge in private credit products can be seen pointing to a growing appetite for alternative investments. As clients look for alternatives to traditional strategies, private credit is becoming increasingly attractive, and this trend is expected to continue into 2024.

Lastly, there is also a noticeable preference for specialised strategies over multi-manager products, suggesting that investors are seeking more targeted investment approaches.

Conclusion

Experienced business development managers with established client networks have been the most sought-after as organisations compete for a shallow pool of exceptional talent. We have observed rapid growth in private credit funds strengthening their distribution capability and expect this trend to continue in 2024.

Amidst economic fluctuations and industry-specific challenges, organisations continuously seek methods to streamline operations and boost productivity. Over the last 12 months, we have experienced firms adopting ‘cost out’ strategies aimed to reduce overall operating expenses.

READ MORE ON THE COST-OUT MODEL

These trends collectively highlight the dynamic nature of funds management distribution, as firms adapt to meet the evolving needs and preferences of investors in an increasingly complex market environment. For all funds management distribution roles, please get in touch with Darragh Cleary below.

Get in Touch

Based in Melbourne and Sydney, Kaizen Recruitment specialises in financial services recruitment across funds management, wealth management, superannuation, investment consulting and insurance. If you’d like to discuss candidate career drivers and the current state of the market within the financial services recruitment landscape, feel free to reach out to us with your details below.

Like what you see?

Please feel welcome to join

Kaizen Recruitment’s mailing list