Fund Accounting Salary Guide 2024

Demand for fund accounting candidates continues to remain strong. Fund accounting professionals with 3-5 years experience are most in demand, particularly those who have a broad end-to-end skillset. Owing to an increased allocation to alternative assets, candidates possessing a skillset across alternative asset classes, particularly private debt and private equity are in high demand.

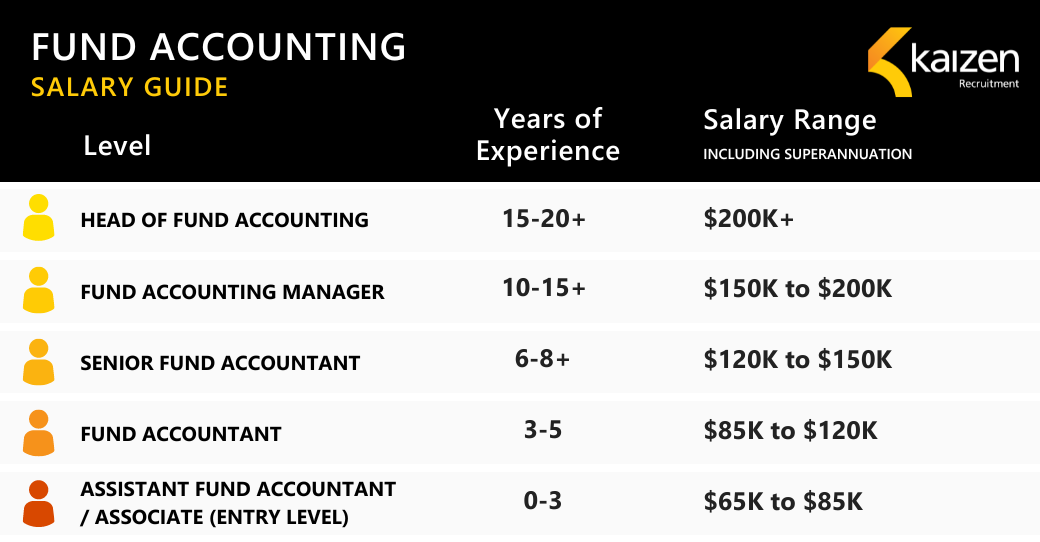

Recruiting for fund accountants at the 1-3 years’ experience level has been most challenging, due to most global firms offshoring junior positions this has resulted to limited exposure to the investment management industry. Kaizen Recruitment tracks remuneration trends annually and are excited to share the salary data below.

*salaries are reflective of the funds management and superannuation industry, with fund services providers typically having differently structured internal teams with global offshore models.

* For senior positions, salary can vary depending on the size of the team and the complexity of operations (asset class coverage across products such as derivatives, systems, etc.). Differences also exist between custodians vs fund managers vs superannuation funds. Bonus structures can also vary from 0-30% depending on seniority, growth phase and performance.

Market Trends

Outsourcing

Evidently, this is not a new phenomenon. Third-party providers based in Australia continue to build large offshore teams in China, India, and the Philippines to remain competitive and leverage cost efficiencies with some backfilling Australian-based positions in these locations in recent years. This challenge will be compounded by NAB Asset Servicing exiting the market, despite a stream of talent emerging from here over the coming months.

As a result, we have observed a lack of end-to-end investment accounting knowledge in the market, which has resulted in challenges in recruiting fund managers and superannuation funds where this knowledge is favourable. In addition, another factor is fund service providers having each function within fund accounting run as a separate team.

Relationship Management Skillset

There is now a definite need for fund accounting professionals with a bespoke relationship management skillset. With most fund managers having outsourced functions, fund accountants are taking on more oversight responsibilities.

In such cases, overseeing and managing the relationship with custodians, third-party administrators, and auditors is a key responsibility. Some of the main skills fund managers are seeking include:

- Clear communication

- Transparency of processes

- Accurate data flows

These positions are likely to remain in demand as fund managers seek to maintain investor confidence, manage risk, and adhere to regulatory compliance.

Private Markets Experience

However, equities and fixed income remain the most common skills in terms of asset class exposure. There has been a notable increase in candidates possessing experience in real estate, private equity, infrastructure, and private debt, however, there remains a gap between demand and supply. There needs to be some flexibility from firms on having this skillset as a requirement for roles, with some firms willing to allocate resources to upskilling and training candidates on this skillset.

Data Analytics and Automation

Fund management firms continue to place a growing emphasis on technology and systems to achieve more efficiency, accuracy and compliance. The role of a fund accountant in Australia will continue to evolve and has resulted in an increased demand for fund accounting professionals with data analytics skills. This shift will result in upskilling and reskilling of existing fund accountants to leverage these advancements.

Cost-out Business Model

Increasingly, we are observing fund management firms adopting a cost-out approach, resulting in several roles restructures and redundancies. This trend is particularly evident in firms operating traditional investment strategies, such as equities and bonds, in stark contrast to firms with investment strategies in areas such as private credit and private debt, where we have observed significant growth. This has resulted in a significant number of senior fund accounting professionals currently being unattached to the market.

Read more on the Cost-Out Business Model

International Talent

With a shortage of end-to-end experience on the market, one potential solution for firms would be to look at international candidates to solve their resourcing needs. We have observed an influx of international fund accounting professionals coming to Australia on working holiday visas. We have noted that most fund managers are reluctant to offer contract opportunities or sponsorship. We have observed fund accounting professionals coming from Ireland, the UK, the USA, China, and India, many of whom bring a broad skillset across fund accounting and would potentially fit well into generalist business models.

Market Outlook

Amid economic fluctuations and industry-specific challenges, there has been positive sentiment from clients regarding their hiring plans for the new financial year.

With private markets experience continuing to be in demand for the foreseeable future, we advise candidates to explore avenues for transitioning into this space or gaining exposure to these asset classes. Additionally, we highly recommend that candidates upskill in data analytics, as this will continue to be a highly regarded skill set.

Candidates with a strong end-to-end skill set with 3–7 years of experience should expect to remain in high demand for the upcoming financial year.

Get in Touch

Based in Melbourne and Sydney, Kaizen Recruitment specialises in financial services recruitment across funds management, wealth management, superannuation, investment consulting and insurance. If you’d like to discuss candidate career drivers and the current state of the market within the financial services recruitment landscape, feel free to reach out to us with your details below.

Like what you see?

Please feel welcome to join

Kaizen Recruitment’s mailing list