Financial Services Risk and Compliance Market Update – July 2024

This past financial year has seen considerable changes in the risk and compliance market with demand for professionals remaining buoyant however the types of skillsets and levels of seniority in demand have seen a considerable shift from last year.

As super funds continued consolidating and merging and external market pressures saw funds management organisations face an incredible amount of challenge and change, Australia remained somewhat insulated from the severe economic constraints seen globally despite local rates of inflation and a considerable amount of regulatory change challenging many businesses.

The start of the new financial year has shown movement pick up, particularly at the Analyst/Officer- Manager levels, with more senior roles seeing increased competition and consolidation resulting in remuneration levels steadying.

Market Conditions and Trends Influencing Businesses

Restructures and Redundancies Noted in Some Areas

Kaizen Recruitment noted several redundancies and restructures ensuing across the market due to the above constraints. These constraints pushed many candidates into the market simultaneously with similar skill sets, particularly coming from the Big 4 consulting firms and the banking industry.

Wealth Remediation Candidates Adjusting Expectations

Remediation projects wrapped last year, including projects at AMP and Deloitte which pushed wealth compliance and risk candidates into the market in tandem. These candidates initially landed with inflated salary expectations having just collected contract rates for the better part of two years. It took some time for these candidates to adjust to what the market would reasonably pay for their skill set. Many hiring managers did not look favourably at those who worked on narrow types of wealth compliance with little depth to their technical skills in this period. Candidates often had to take a step back in remuneration to re-enter the market, and many had to step back in seniority.

Sydney Sees More Restructures Initially

Another swath of candidates entering the market came from operational risk and compliance backgrounds. Two of the Big 4 Banks and Macquarie Group held large-scale redundancies in Q3-Q4 last year, mainly in the Sydney market. This left candidates from the banking industry competing for roles in other financial services verticals or moving externally to industries such as energy which benefitted in acquiring risk and compliance candidates who had operated in more heavily regulated environments.

Regulatory-related Conditions

- “Fears” of FAR, particularly at the executive and board level, have led to an increased appreciation of the worth of risk management, enterprise resilience and compliance

- Regulatory pressures continue with ASIC earmarking a historic amount for future investigations in FY24/25

- Multiple large pieces of regulation work to implement including CPS/SPS 230, 234, 511 and FAR replacing BEAR for all APRA-regulated entities

- Regulators putting pressure on the trustees have an on-flow effect on workloads

- Undertaking Operational Due Diligence (ODD) on external managers will be required in-house in super funds requiring businesses to create and build teams and internal talent

Other Considerations: ESG, marketing demands increase, and more

- ESG and Sustainability are an increasing focus which creates more work within organisations

- Insourcing of investment teams and increased FUM means more investment risk and compliance as well as business support work for risk and compliance professionals to manage

- Churn internally in ASIC and APRA employees creating constraints in understanding, liaising, and interpreting as organisations cite the duplication of similar requests burying them in administration

- High-profile scandals have executives and boards looking to manage their reputational damage (and stay out of the negative press) through better risk practices

- Heavy public fines and the cost of large remediation programs are an incentive for executives combined with pressure from the board to avoid the pitfalls of their peers

- More involvement of risk and compliance teams in reviewing marketing and communications

Cost Out Driving Restructures Leaving Leadership Gaps with Green Teams Remaining

Kaizen Recruitment noted a trend called “Cost Out” which we saw play out across several businesses. This occurred where the restructuring at the top (EGMs, GMs, Heads of) would be made redundant or consolidate roles into one position, and this liquidity could be reinvested into the businesses or used to account for the considerable overspends in technology and transformation projects.

READ MORE ON THE COST-OUT MODEL

Business Fail to Retain Top Risk and Compliance Talent

This would often result in multiple Analyst/Officer, or Senior Analyst/Officer levels being hired to pick up the more administrative lifting at the bottom of teams leaving middle managers feeling the pinch as project work was bolted onto BAU workloads with fewer leaders to manage project streams, quality of output, timelines of delivery and people management.

This weakened leadership has been cited as causing a lack of retention at the middle management levels and junior staff not feeling like they are being properly developed. The best candidates continued to have options and we saw heavier movement akin to a “merry-go-round” of talent from one fund to another as businesses lost key talent and had to cough up funds to rehire and train new staff in their place.

Executive Leaders Resigning Citing Burnout

The lack of senior leadership in businesses noted seemed to result in a trend not seen previously with executives and senior leaders resigning before the holiday break over Christmas without another role to go to. Many cited increased workloads due to heavy changes in regulation, years of change, project and transformation work, a delayed burnout felt due to COVID-19, and a severe lack of talent and headcount to meet workload demands on teams as the reasons they resigned.

The Domino Effect- Skilled Candidates Moving in Search of More Reasonable Workloads

Another trend noted was on the middle management to senior manager candidate level where many questioned if a career in risk and compliance would be sustainable long term. These candidates cited a lack of foresight in hiring to cover parental leaves or long holidays across staff leaving workloads to fall on existing employees.

Frustration around delayed hiring practices and running very lean teams, as a result, seemed to create this domino effect where a candidate would resign, the workload would fall onto the remaining staff leading to further burnout and having to allocate time to sit in interviews to choose a replacement- only to have that manager then resign to take another (hopefully less stressful) position.

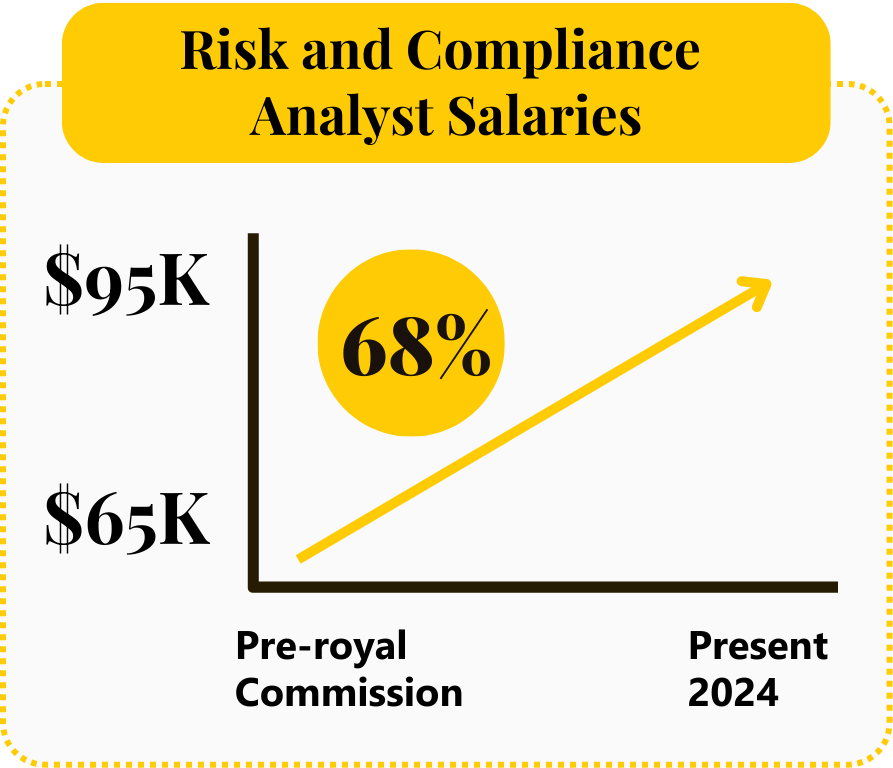

Salaries Have Stopped Increasing Exponentially, but Remain Steady

Since the Royal Commission financial services risk and compliance professionals have had considerable increases in their remuneration. In fact, during this time we have seen entry-level salaries at the Analyst/Officer level candidates increase 68% going from $65K pre–Royal Commission to $95K to hire the same 1 year of risk and compliance experience.

While this was the biggest jump, there has been an upward trajectory in salaries across all levels in the space. The lack of available talent in the market with increased demand allowed candidates to push for the best financial outcomes. We have seen this temper in the last two quarters with remuneration remaining consistent as more candidates enter the market through international migration or the push of certain sets of skills and more senior candidates into the market.

Employers Still Paying More for Top Talent

Firms however are still competing for the same skill sets seemingly at the same times as regulators turn up the heat on organisations to meet their deadlines to implement these changes. This competition still pushes businesses to pay more for highly skilled candidates with strong technical and solid communication skills and particularly exposure to new pieces of regulatory work, GRC and technology implementations and business partnering in Line 1.

Generalists versus Specialists

The displacement of senior risk and compliance leaders has led to senior candidates needing to flex on their salary expectations as they move into industries such as insurance, wealth and superannuation that typically do not have the depth of pocket to meet the historic banking remuneration levels. However, we have seen a few of the large industry super funds meeting these salaries to secure the best people and pay in the top 90-100th percentile of the market.

With organisations focusing budgets on niche risk and compliance skills, the generalist skill sets of many at this level are not as desirable and candidates will be guided to choose roles that have a sharper focus on a niche area of risk and compliance specialisation. We see this as a clear trend of roles to come as generalists in banking and consulting have already experienced this as they were pushed into the market late last year.

Conclusion

We forecast the shallow skill sets of risk and compliance professionals, particularly in superannuation and funds management, will continue into 2025 as organisations compete for niche skill sets as they all mirror the same scaling in preparation for regulatory changes impacting business.

To find out where this leaves remuneration benchmarking, stay tuned for our next article: Financial Services Risk and Compliance Salary Guide 2024

Get in Touch

Based in Melbourne and Sydney, Kaizen Recruitment specialises in financial services recruitment across funds management, wealth management, superannuation, investment consulting and insurance. If you’d like to discuss candidate career drivers and the current state of the market within the financial services recruitment landscape, feel free to reach out to us with your details below.

Like what you see?

Please feel welcome to join

Kaizen Recruitment’s mailing list