Financial Services Quarterly Market Update – November 2024

From the rise of specialised roles in marketing and investment operations to the increasing emphasis on risk management and ESG compliance, the financial services landscape has continued to transform in 2024. This year, several corporate restructures and the continued rise of private markets have further influenced each sector in distinct ways, reshaping strategies and operations across the board.

Organisations are recalibrating their strategies to align with these changes, creating both opportunities and challenges for executives seeking to navigate this intricate environment. While each sector exhibits its unique characteristics, common threads of adaptability and resilience emerge as critical factors for success. In this article, we explore the latest developments across leadership and the various verticals across the financial services, providing insights into how these trends shape the future of financial services recruitment.

Overview

This last quarter, the financial services market has experienced a decline in overall job growth, with mixed demand across various roles. Notably, sectors such as risk & compliance and distribution remain relatively active, highlighting targeted pockets of resilience.

The executive market has become increasingly competitive, especially for roles commanding salaries between $200K and $600K. Due to a substantial oversupply of highly skilled candidates, especially at senior levels, recruitment processes have become more prolonged. Executives often face extensive job searches, sometimes exceeding a year, compounded by recent industry restructures and a limited number of available roles.

Investment operations and fund accounting continue to see a strong trend toward outsourcing, reshaping the local talent landscape. Junior roles are diminishing as companies emphasise oversight positions, resulting in a scarcity of entry-level opportunities and a widening pay gap between senior and junior roles. Despite this, the demand for talent with private markets experience persists, reflecting a need for niche expertise.

Meanwhile, roles in marketing and communications continue to play a vital role in driving revenue, especially as organisations seek digital media and acquisition talent to support growth initiatives. ESG and responsible investment have also experienced a shift, with new sustainability reporting standards prompting increased demand for ESG professionals.

Executive Search in a Crowded Market

Executives find it increasingly challenging to secure new roles, often taking over 12 months to land meaningful positions. This prolonged search period is primarily due to an oversupply of highly qualified candidates, particularly at the C-suite and senior management levels. Restructures and redundancies across the industry have compounded the issue, naturally leading to fewer available positions and fiercer competition.

Our team has experienced firsthand the overwhelming and remarkable quality and abundance of candidates seeking opportunities. For instance, during a recent search for a General Manager of Investments, we shortlisted 15 highly capable candidates (all of them, excellent). Due to the overwhelming volume of interest, this led us to close application processes early.

Amid the challenge of selecting top talent in such a competitive market, we have successfully placed several executives within the past three months alone across various roles, including Chief Financial Officer, Head of Finance, Chief Member Officer, Chief of Staff, Head of Distribution, and General Manager of Investments.

While there is an oversupply of talent, there hasn’t been significant downward pressure on salaries. However, executives are finding it more difficult to negotiate higher packages, often prioritising securing a role over pushing for superior compensation. Furthermore, work flexibility—once an important negotiating point—has become less of a priority, with most executives now willing to trade it for job security and a stable position at a reputable organisation.

An important observation we’ve noticed is the increasing value of personal brand and reputation. Strong professional networks and executive relationships have proven crucial, as several CEOs have relied heavily on peer recommendations to identify preferred candidates. Therefore, maintaining and investing in these relationships is vital, regardless of your career stage.

In summary, while the current market offers clients a broader selection of executive talent, for candidates, the journey to securing a new role has become more challenging and competitive than ever.

Increasing Activities in Sales and Distribution

The sales and distribution markets saw a notable increase in hiring activity last quarter, with private credit funds especially focused on bolstering their distribution capabilities. This trend is expected to continue through 2024. Additionally, several major global firms have acquired stakes and made significant capital investments in prominent Australian private credit organisations, underscoring the sector’s growing appeal.

Interestingly, we have identified a shortage of candidates with 3–5 years of experience in business development, likely a result of hiring freezes implemented during the COVID-19 pandemic. These measures, taken around 3–5 years ago, are now impacting talent pools at this experience level, as candidates who would have entered the field in entry-level roles during that period were unable to gain the necessary experience.

The outlook for the sales and distribution market remains robust, with continued demand for experienced talent and sustained investment in distribution channels, especially within private credit. As firms work to address the shortage of mid-level business development professionals, the focus will likely shift toward strategic recruitment and targeted development programs to bridge this experience gap and support long-term growth.

Growth in Front-Office Investment Roles

The continued internalisation of investment management within superannuation has spurred a rise in front-office roles within these funds across broad asset classes. Over the past 12 months, LinkedIn data reveals that major superannuation funds have reported an average 10% growth in Investment Analyst and Senior Investment Analyst positions, reflecting increased demand for in-house expertise.

In contrast, smaller fund managers, particularly those outside sectors like Infrastructure, Private Debt, and Private Equity, have faced challenges from this internalisation shift. Some have experienced lost mandates, leading to stagnation or even declines in growth.

This hiring landscape is shaped by multiple factors, including recent immigration surges, redundancies, and corporate restructuring. While these trends have expanded the candidate pool, this continues leading to fewer available positions, intensifying competition for roles with niche and role-specific skillsets. Demand remains high for candidates with experience in alternative asset classes such as private debt, infrastructure, and private equity, alongside strong quantitative capabilities—proficiency in Excel, financial modelling, and familiarity with business intelligence or coding tools (e.g., Python, Power BI).

Diversity also remains a key focus. According to Future IM/Pact, female investment analysts currently comprise just 28% of the workforce. Although this is a 4 percentage point increase from Mercer’s study seven years ago, many organisations continue to prioritise empowering and advancing female talent to enhance diversity within investment teams and build pathways to leadership roles.

Looking ahead, superannuation funds will likely focus not only on attracting candidates with specialised skills but also on improving diversity and fostering an inclusive workforce. As a result, investment teams that balance niche expertise with diverse perspectives are expected to be well-positioned to navigate an increasingly competitive and complex investment landscape.

Investment Operations and Fund Accounting Insights

The Continued Trend of Outsourcing Investment Operations

With less development opportunities, outsourcing has also affected the attractiveness of developing a career within operations as candidates target growth sectors such as risk and compliance instead. This is already starting to lead to a lack of junior-level talent. Offshoring has also skewed salaries and has increased the gap between the well-paid, experienced workers who are working in an oversight capacity and poorly paid, less experienced workers whose roles can be performed more cheaply by an overseas team.

READ MORE ON OUTSOURCING TRENDS

Increased Hiring For Senior Roles

In contrast to the challenges facing junior roles, demand for experienced Analysts and Senior Analysts has surged. Last quarter, we observed a notable increase in hiring activity within investment operations, with candidates skilled in end-to-end investment operations frequently involved in multiple interview processes—a marked change from previous quarters.

Meanwhile, the senior end of the investment operations market remains comparatively “softer,” with roles at the $200K+ level being less prevalent. Following recent restructures over the past 12 months, strong senior talent is readily available. In turn, this contributed to longer hiring timelines as businesses feel less urgency to secure preferred candidates immediately.

Private markets continue to be a primary area of demand, with candidates possessing private credit and private equity experience being highly sought after. However, supply is not meeting demand in this space, and last quarter, positions required a detailed candidate search. With significant M&A activity across the funds management and superannuation space, there is growing demand from clients, for investment operations candidates possessing strong transitions and project management experience. Additionally, a stream of talent continues to flow out of NAB Asset Servicing as they exit the market, which has greatly assisted funds management and superannuation clients in recruiting for operational positions.

As the outsourcing of investment operations persists, the sector is experiencing both an evolving workforce structure and a widening skills gap. Junior-level roles face increasing scarcity, while the demand for skilled senior analysts with broad operational expertise and specialised knowledge in private markets remains robust. This dual trend—towards outsourcing in routine roles and heightened selectivity in senior and niche roles—signals a strategic shift in how organisations balance cost efficiencies with the need for high-caliber talent. Moving forward, firms will likely continue seeking innovative ways to address these challenges, aligning talent strategies with the industry’s growing complexity and evolving operational needs.

ESG and Responsible Investments

Australia’s New Sustainability Reporting Standards Drive Demand for ESG Reporting Professionals

The Australian Accounting Standards Board (AASB) recently finalised and enacted the Australian Sustainability Reporting Standards (ASRS), S1 and S2. With these standards now incorporated into legislation, organisations across industries, particularly outside of financial services, are ramping up efforts to enhance their Environmental, Social, and Governance (ESG) and sustainability practices. This trend is spurring an increase in demand for ESG and sustainability roles, reflecting a shift towards more structured and mandatory reporting requirements.

The ESG Talent Market

When it comes to the talent market, the ESG and responsible investment sector has seen a recent slowdown in hiring activity following years of robust recruitment. Broader economic uncertainties and reduced turnover among current employees in these roles likely influence this pause. Despite this temporary lull, many fund managers and superannuation funds have already integrated ESG reporting into their operations, positioning themselves ahead of the curve.

In contrast, other industries are experiencing a surge in recruitment for ESG and sustainability roles, particularly in consulting within professional services, engineering, asset consulting, and environmental consulting firms. These sectors are expanding their capabilities to support businesses aiming to establish internal ESG functions. Often, firms seek specialised expertise or external consulting services to fulfil their sustainability requirements without committing to full-time hires.

The demand for ESG skills and resources is expected to grow steadily over the coming years, driven by the evolving regulatory landscape and increasing corporate focus on sustainability. However, there is still uncertainty about whether the talent pool will be sufficient to meet the needs across all industries. Ensuring there is enough depth and quality in the ESG talent market will be a critical challenge for organisations looking to fulfil their sustainability commitments.

Risk and Compliance

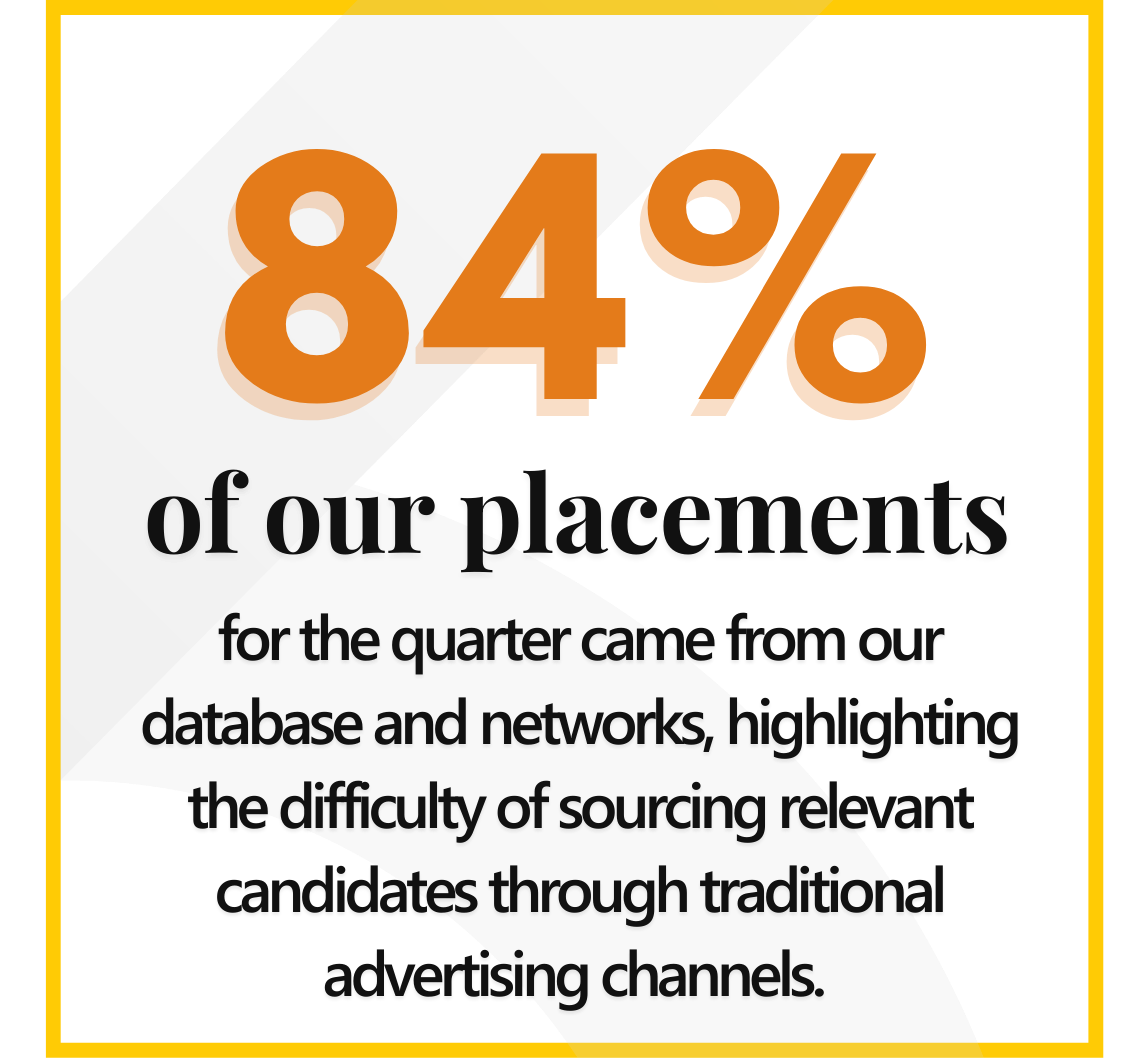

There has also been an increase in the number of applicants for analyst-level roles, with our ad campaigns consistently receiving over 200 applicants per position. Despite this influx, finding skilled talent remains a challenge. Notably, 84% of our placements for the quarter came from our database and networks, highlighting the difficulty of sourcing relevant candidates through traditional channels. This reinforces the need for targeted recruitment strategies to attract the right talent in a competitive market.

Currently, with many restructures happening across the financial services industry, particularly in consulting, we are seeing an influx of candidates looking to transition to industry roles. The challenge has been helping these candidates navigate this move while managing their expectations. Many are seeking to step into more senior roles with an increase in salary, but they often lack key industry experience and are outpriced compared to candidates already within the industry.

Marketing’s Resilience: Driving Revenue Amid Regulatory Scrutiny

Despite the persistent scrutiny from regulatory bodies like ASIC and ongoing economic uncertainty, marketing continues to drive revenue growth and play a strategic role within financial services. Organisations are focusing on key marketing competencies to navigate this complex landscape effectively. Currently, the three most sought-after skill sets are:

Acquisition Marketers: These professionals are instrumental in setting and achieving Objectives and Key Results (OKRs), ensuring that marketing initiatives align closely with broader business goals. Acquisition marketers with a strong data-driven approach are especially valued, as they can accurately measure campaign effectiveness and optimise customer acquisition strategies.

Content Marketers: As mergers and acquisitions reshape the superannuation and financial services sectors, content marketers are increasingly tasked with creating cohesive brand narratives that can engage both new and existing audiences. Beyond content creation, these professionals are expected to execute large-scale branding initiatives, establishing the organisation’s identity in a competitive market.

Digital Media Specialists: With the growing need for integrated media strategies, digital media professionals are playing dual roles in managing both above-the-line (ATL) and below-the-line (BTL) media. Their expertise in balancing brand awareness campaigns with direct response initiatives has become essential as organisations aim to reach diverse audiences effectively across multiple channels.

Additionally, Q1 has shown a trend of marketing talent filling roles such as Experience Managers, Product Managers, and Proposition Managers. This shift highlights the versatility of marketing professionals and underscores the increasing overlap between marketing, product, and customer experience functions in driving customer-centric growth strategies.

Summary

In summary, today’s market presents clients with a wider talent pool amid recent restructures and merger activities, however specialised roles remain difficult to fill. Candidates face an increasingly competitive path to securing new roles due to a growing number of applications on average per position. Across each vertical, demand for distinct skills continues to pose challenges for hiring managers seeking niche expertise, especially in private markets. Despite variability in financial services recruitment, the need to proactively source top talent and reliance on building strong networks remain essential to attract top talent and for candidates to secure sought-after roles in the market.

Get in touch

Based in Melbourne and Sydney, Kaizen Recruitment specialises in financial services recruitment across funds management, wealth management, superannuation, investment consulting and insurance. If you’d like to discuss candidate career drivers and the current state of the market within the financial services recruitment landscape, feel free to reach out to us with your details below.

Like what you see?

Please feel welcome to join

Kaizen Recruitment’s mailing list