The Evolving Employee Value Proposition – Part 2: Steps to Creating a Great EVP

There is no denying the financial services recruitment landscape has significantly changed in recent years. With demand for talent clearly outstripping supply, candidates are in the driver’s seat with many fielding multiple job offers whether they’re actively looking for a new role or not.

In this environment, it is essential to position your company above your competitors to not only attract top financial services talent but retain your existing valued staff. It is a clear and constant message about the experience of working at your organisation and emphasizes the distinctive experience that entices, engages and retains top talent in the market. This second article in our series explores how your Employee Value Proposition (EVP) can do that, alongside some advice for crafting yours.

Your EVP – What it is and Why it’s Important

At its core, your EVP is a statement of what you offer current and potential employees in return for their work endeavours. The best EVP offerings help your staff achieve their potential by actively engaging them in their daily tasks, as well as your greater company purpose.

A strong Employee Value Proposition draws from your company values and culture, however, it can also reveal the professional development opportunities and employee recognition and benefits you offer.

If written well, your EVP enables candidates to accurately surmise if their work style and career aspirations align with how you work. This increases your chances of finding your right cultural fit, with the bonus being a reduction in the chances of making a bad hire and subsequent rehiring costs.

In addition, a powerful EVP differentiates you from your competitors by clearly showcasing the unique qualities and working conditions you possess. By delivering on these promises, recent Gartner research shows you can reduce annual employee turnover by just under 70%, while also increasing new hire commitment by close to 30%.

These are all compelling reasons for developing a clear and enticing company EVP. The following steps will assist you in this task.

Step 1: Uncover Employee Wants and Wishes

The first step in defining your EVP is understanding what employees want. As sourcing this information is an important part of our role as a specialist financial services recruitment agency, we recently conducted a LinkedIn poll on the topic.

We asked candidates their top priority when searching for their next role. These are results:

- 37% flexible and hybrid work arrangements

- 33% career progression

- 29% remuneration uplift

In addition to these figures, the 2022 Deloitte and Swinburne Edge Report found 93% of workers ranked their wellbeing as just as important as their pay. Work autonomy, leadership and performing impactful work followed closely behind.

Interestingly, they also uncovered that two in three Australian workers are willing to forgo a pay raise for flexible working conditions (one in five would sacrifice between 6% and 10% of their salary).

While these statistics give you some idea of the types of benefits potential financial services candidates want from their workplaces, conducting internal employee surveys is also a smart step to gain an understanding of what your current employees enjoy about working with you, and why they choose to stay. You may like to include exiting employees and potential candidates in this survey. You can then use this vital intel to shape your evolving EVP.

We recommend organisations spend some time putting together your individual surveys ones that can be done anonymously if you prefer. If you lack the time or expertise, you can consider using the skills of a specialist financial services recruiter to assist with tips for creating, disseminating, gathering and reviewing your employee survey data.

Consider some or all of the following questions:

- Current employees:

- What do you value about working here?

- What do you feel is unique about our company?

- Why do you stay?

- What improvements would you like to see?

- Exiting employees:

- Why did you choose to leave?

- Is there anything that would have made you stay?

- Potential employees:

- What attracts you to this company?

- What kind of support would you like from us to help you achieve your professional development goals?

It is also advantageous to have senior leaders within the organisation undertake the survey as well, to measure your leader’s insights against your employees and potential employees.

Once you have your data, carefully review it and look for your unique selling points as well as the company values and offerings employees feel are most important (consider career growth opportunities, flexibility, salary and benefits, culture/working environment). This lays the groundwork for building your EVP.

Step 2: Carefully Construct Your EVP

Use your data to now create your EVP. Aim for clarity while remaining succinct, ensuring it encapsulates what your employees love about your organisation and why potential candidates should consider working with you.

You may like to write multiple versions of your EVP, along with specific variations targeting candidate cohorts, such as graduates, mid-level professionals and seasoned specialists. After you have created your EVP/s, ask yourself the following questions:

- Do they align with your company’s core values, vision and mission?

- Do they align with your employees and potential employee’s expectations?

- Does it assist you in standing out from your competitors?

- Are they clear, appealing and inspirational?

- Do they portray a realistic view of working at your organisation?

Once you have your completed EVP version/s, consider testing them with existing employees, an external focus group and/or your trusted financial services recruitment consultants. Focus on if it accurately captures why someone should consider working with you.

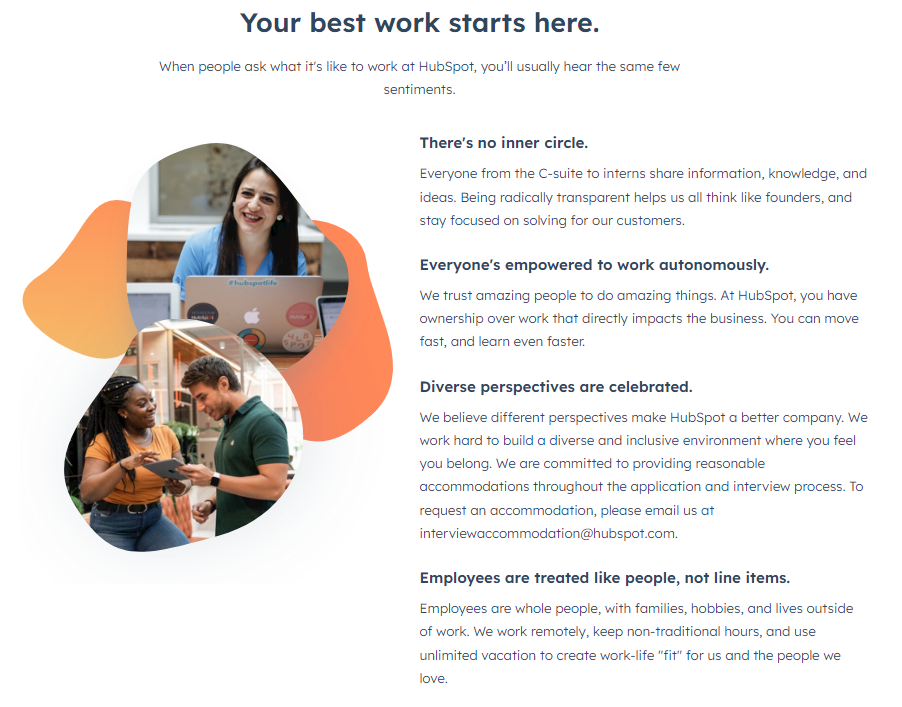

An example of a strong EVP can be found on HubSpot’s Careers website which instantly demonstrates what it would feel like to work with their business. It’s based on themes around flat structure, autonomy, diversity and recognition. It’s also written in a friendly, personable way that reflects HubSpot’s brand.

Step 3: Communicate Your EVP

Once you have your EVP, it is important to embed it throughout the company. This includes externally in your corporate website and blog, social and professional networking profiles, and internally in company communications, strategic planning documents and reward/recognition programs.

Be sure to include your EVP across all of your recruitment touchpoints too. This includes recruitment materials, interview emails and follow-up, offer letters, pre-boarding and onboarding collateral.

It is worth noting that perhaps the most powerful purveyors of your EVP are your current employees. An employee opinion often carries much greater weight than that of a manager, so getting them to articulate what makes working at your company so special is vital. Consider showcasing your EVP in action through employee video testimonials, blogs or LinkedIn pieces.

Step 4: Monitor, Review and Update

The final step in your EVP creation process is to review its success. Pay attention to metrics such as:

- High engagement on social platforms and EVP related posts

- An increase in passive candidates approaching you

- A boost in the number of candidates applying for and accepting your roles

- A reduction in your time-to-hire and attrition rate

- A rise in hitting your recruitment and retention targets

- An increase in employee referrals and positive online reviews on sites like Glassdoor

It is wise to review your EVP annually to ensure it remains relevant to the business and continues to attract and retain top financial services talent. Keep up your employee and exiting employee surveys to help you stay on top of current sentiments around your EVP offerings, and incorporate edits as necessary.

Engage With an Expert

Those are four key steps to assist you in creating your essential EVP. As you can see, it is a somewhat lengthy process but one that is highly valuable, especially in these candidate-driven times.

With deep roots in financial services recruitment, we are committed to supporting our clients in funds management, superannuation, insurance and wealth management to both attract and retain elite employees.

If you need additional assistance with any part of creating your EVP, whether it is reviewing your current offerings, support with insights on best practice for employee and exiting employee interviews, evaluating your data or reviewing your EVP versions, please let us know.