Financial Services Job Market Update – October To December 2020

It was a busy finish to the year with near record levels of recruitment for the Kaizen team. We are so grateful to work in an industry that has been so resilient during COVID and a recession economy.

Many of our Victorian based clients had started planning or indeed commenced returning to an office environment. While the ideal future working situation remains undecided for many organisations, our survey was unanimous with 86% of professionals only wanting to work two or three days a week in an office environment.

For the period of October to December 2020, 50% of our recruitment assignments were completed within funds management, with investment accounting, investment operations, ESG and risk & compliance professionals being in strong demand.

There was plenty of opportunities for experienced investment operations and investment accounting professionals, with many candidates receiving multiple offers. One candidate had three clients competing for his services and ultimately, he received a 50% salary increase to join a leading super fund.

The demand for ESG professionals is increasing, clearly outstripping supply of experienced professionals. Many funds are competing for the same limited supply of talent and it was challenging to find professionals who had the desired blend of genuine investment knowledge and ESG experience.

Our national superannuation industry survey revealed the hiring intensions of superannuation funds in every state. While every fund had different recruitment needs, there certainly was some consistency as to the skills in demand, these included:

- Data professionals, and in particular investment data

- Project manager and business analyst as more projects were ramping up (projects around investment & investment systems, and administration, IT, technology risk and cyber security)

- If you have acurity system skills, demand is still exceeding supply

- We have broadly seen that risk, compliance and legal professionals remain in strong demand, with some teams doubling in size

- Investment professionals remain in demand too, especially if you are an asset class specialist

The positions we delivered on included investment managers and analysts with several fund managers, super funds and one insurance firm. More investment accountants then we have ever placed in any quarter. Numerous client and investors services positions, and investment operations position. Marketing coordinators and senior marketing specialists in funds and insurance and several risk and compliance managers.

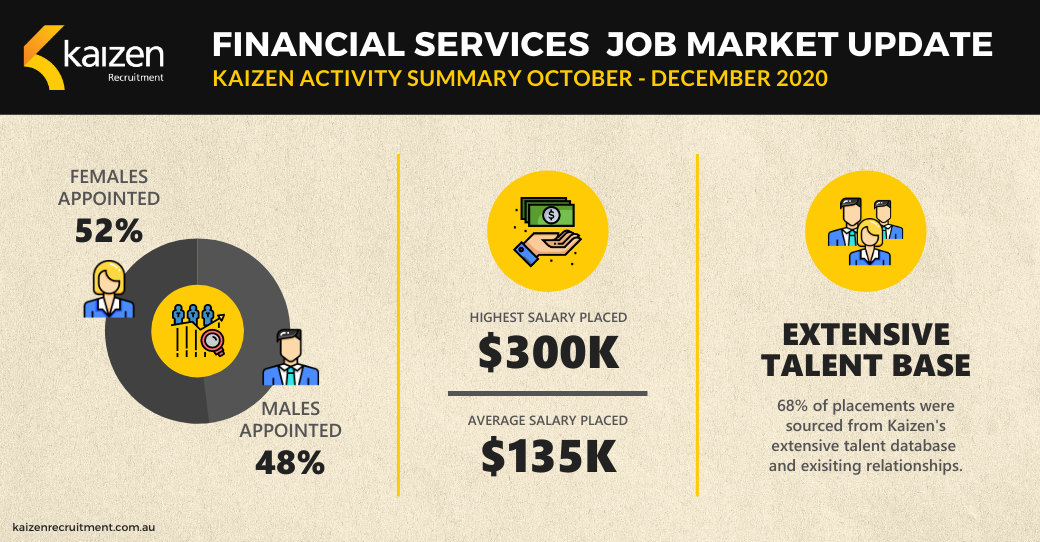

The average salary of all positions we delivered on was $135K, with the highest salary at $300K.

68% of all placements came from candidates which we had previously interviewed via our database or our existing network.

52% of placements were female, which aligns with our goal to ensure all our shortlists have equal representation from a gender diversity perspective. The demand for female candidates with investment experience was again high with some of our clients aiming to achieve a 40 / 60 ratio within their investment teams.

We would like to thank our valued clients, Victorian Funds Management Corporation, REST Super, Generation Life, CCI, Equity Trustees, Prime Super, legalsuper, Zenith Investment Partners, Payton Capital, Cooper Investors, ACSI, Paradigm Group, Aware Super, IFM Investors, Franklin Templeton, APN Funds Management, U Ethical and Shareies for giving our team the opportunity to partner with their businesses on a range of talent acquisition opportunities.

We hope you like this summary of our activity during the October to December quarter and we are looking forward to working with our valued clients again in 2021.

Kaizen Recruitment specialises financial services recruitment across funds management, wealth management, superannuation, investment consulting and insurance. We are based in Melbourne and Sydney. For assistance or further information please telephone our office at +61 3 9095 7157 or submit an online form.

Like what you see?

Please feel welcome to join

Kaizen Recruitment’s mailing list