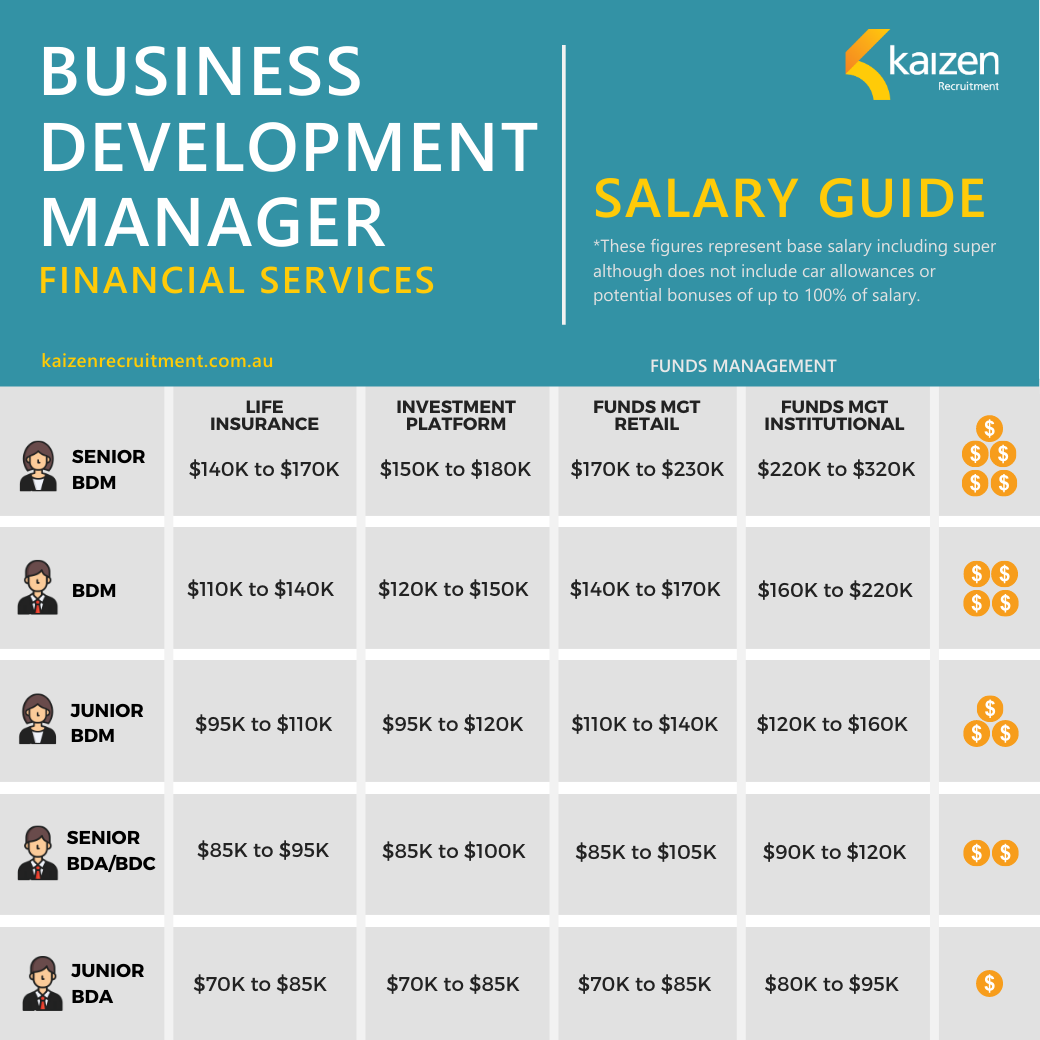

Business Development Salary Guide Financial Services 2020

The outcomes of the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry and changes to financial advice education standards has resulted in a slowdown across the financial advice industry. The follow on effect has been a decreased demand for business development professionals within retail funds management and retail life insurance.

There has also been a reduced demand for institutional fund manager business development professionals as industry superannuation funds merge and also internalise their investment capability.

Even though there are current headwinds within financial services, business development professionals salaries remain buoyant.

What skills are firms looking for in a business development professional?

Successful business development professionals connect with a range of diverse personalities and build trust with their clients, therefore, the ability to build rapport is the most important skill in a sales role. Companies will generally only consider BDMs that have an existing client network, which takes a long time to establish. Lastly, it’s also a given that BDM’s know their product’s features and benefits relative to their market competitors.

What qualifications are required?

There are no specific education requirements, however most fund managers, insurersand platform providers expect their BDMs to have a bachelor’s degree as a minimum. Most retail fund manager BDMs are RG 146 qualified and most institutional fund manager BDMs have completed either a CFA designation or a Master’s in (Applied) Finance, with some exceptional BDMs completing both.

What is the career path to become a business development manager?

Most platform, insurance or retail funds management BDM’s started off their career within financial planning, in either a client service, paraplanner or associate adviser capacity. This role is pivotal in understanding the financial planning process and understanding the expectations of the end client. Generally, after 18 months to 5 years working within a financial planning related role, the next step is to move into a business development associate (BDA) /consultant (BDC) position to learn the tools required to become a successful business development manager. Most BDAs undertake an ‘apprenticeship’ over a period of 18 months to 3.5 years before given the opportunity to step up into a business development manager.

In contrast to the above, most institutional fund manager BDMs generally come from an investment analyst background, either buy-side or sell-side. Institutional BDMs generally have more in-depth and detailed investment conversations with their clients, hence require greater market and investment knowledge. Their clients include asset consultants, superannuation funds, government organisations etc.

What bonus can a BDM expect to receive?

Bonuses vary from organisation to organisation, with majority of BDMs receiving bonuses between 35% – 55% of their base salary. Due to the current market headwinds i.e. royal commission, the bonus amounts are down from previous years. Most bonuses are based on a combination of qualitative and quantitative (individual and company) factors.

What does a head of sales professional get paid?

Salaries of head of sales/distribution professionals can vary substantially depending on the size of organisation and how many direct reports in the sales team. A salary for a head of distribution for a fund manager can range from a low of $180k and up to a high $350k.

For all client services, business development associate or business development manager roles within insurance, investment platforms or funds management, please contact Matt McGilton at Kaizen Recruitment on 03 9095 7157 or info@kaizenrecruitment.com.au.

Kaizen Recruitment specialises financial services recruitment across funds management, wealth management, superannuation, investment consulting and insurance. We are based in Melbourne and Sydney. For assistance or further information please telephone our office at +61 3 9095 7157 or submit an online form.

Like what you see?

Please feel welcome to join

Kaizen Recruitment’s mailing list